Bitcoin Price Outlook: Analyzing the Current Market Trends and Levels

Bitcoin is experiencing a gradual upward trend while being constrained within a specific range due to risk appetite. It is currently fluctuating between critical EMAs, with the $90,000 threshold being vital for a potential breakout to $100,000. However, the market still faces risks of further declines if support levels are breached.

In the early hours of Tuesday, the Bitcoin market displayed a gradual upward movement; however, it remains constrained within a specific range. This persistent behavior appears to be attributable to the prevailing risk appetite among traders in the BTC market.

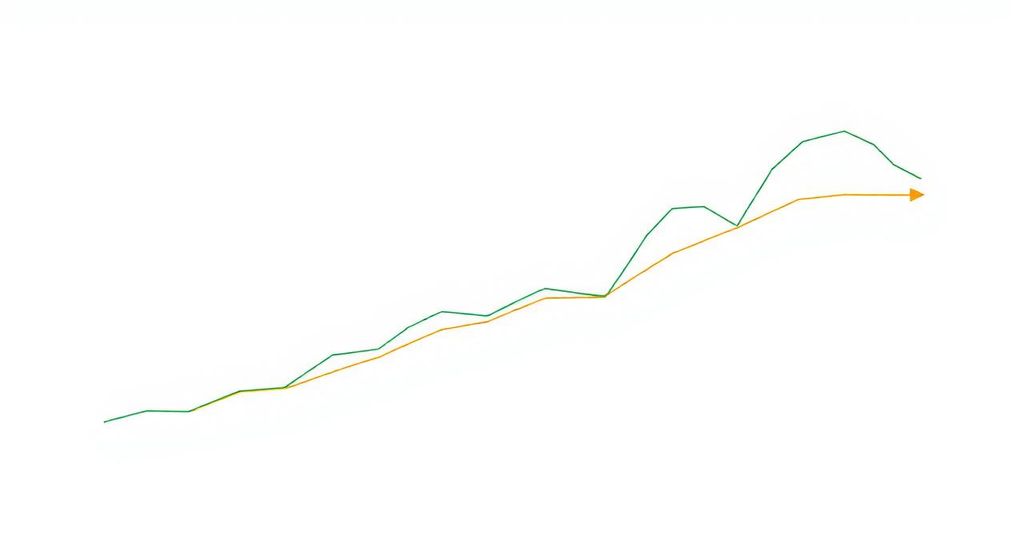

Currently, Bitcoin oscillates between the 200-day and 50-day exponential moving averages (EMAs), which often indicates potential volatility. The focus rests on the critical $90,000 threshold situated above the 50-day EMA. A successful breach of this level could catalyze a significant advance towards the $100,000 mark. Conversely, should the market decline, support may be found at the 200-day EMA, with $82,500 potentially emerging as the next target if that support fails.

Volatility is anticipated in this environment, as Bitcoin is perceived as a high-risk asset requiring a resurgence in risk-taking behavior among traders. It has evolved into a pseudo-ETF, with Wall Street exerting considerable influence on its trajectory.

Despite recent upward pressures, the Bitcoin market remains in a consolidation phase, which has persisted for several weeks. The critical question looms: can Bitcoin finally surpass the substantial barrier of $90,000?

The Bitcoin market is currently in an upward trend but remains confined within a range influenced by traders’ risk appetites. With crucial EMAs indicating potential volatility, a breakout above $90,000 could lead to substantial gains towards $100,000. Conversely, failure to maintain support at lower levels could bring about further declines. A decisive movement in either direction seems imminent as the market continues to consolidate.

Original Source: www.fxempire.com

Post Comment