Technical Analysis: Expert Reveals Reasons for Bearish Outlook on Bitcoin

Technical expert Tony Severino has shifted from a bullish stance on Bitcoin due to recent price declines. Citing Elliott Wave Theory and market sentiment, he suggests Bitcoin may have reached its peak, with key indicators pointing to a weakening upward momentum. Severino also notes the historical context surrounding Donald Trump’s inauguration as a contributing factor to this sentiment.

Tony Severino, a technical expert, recently expressed his shift away from a bullish stance on Bitcoin (BTC) and the broader cryptocurrency market, citing a recent Bitcoin price decline. Severino had previously indicated the possibility of Bitcoin dropping to a low of $22,000. In his analysis on social media, he referenced market cycles and the Elliott Wave Theory to substantiate his position.

Severino analyzed the Bitcoin price movements in relation to Elliott Wave Theory, noting that both Wave 1 and Wave 5 exhibited a 100% price increase during this market cycle, starting from November 2022. He posits that the current top could have been reached since Waves often show similar price patterns. Nevertheless, he acknowledged the potential for Bitcoin to experience further gains, akin to those seen in Wave 3 following the launch of Bitcoin ETFs last year.

Citing the significance of market sentiment, Severino linked his bearish outlook to euphoria surrounding Donald Trump’s inauguration, which historically tends to precede market peaks. He observed that while the anticipated excitement was less than expected, the cyclical peaks of previous waves suggest that Wave 5 is likely to trial at similar highs.

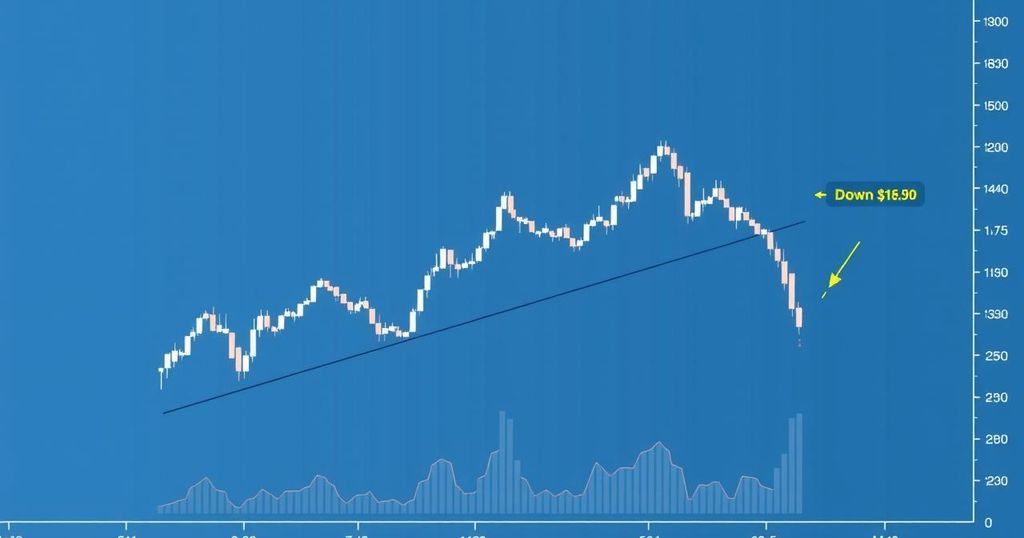

In addition to the Elliott Wave analysis, Severino presented additional indicators signaling that Bitcoin may have hit its peak price. His observations included a trendline indicating that Bitcoin had reached maximum financial opportunity in this cycle, alongside indicators such as the Parabolic SAR and the Average Directional Index (ADX). These tools reveal a potential market reversal as BTC’s upward momentum appears to be diminishing.

Severino concluded by emphasizing that indicators such as the Logarithmic MACD also suggest a decline in Bitcoin’s market momentum, reinforcing his assessment that the cryptocurrency is unlikely to recover its upward trajectory in the near future. In conclusion, his analysis highlights a significant bearish outlook on Bitcoin and reinforces concerns regarding its current price levels and market conditions.

In summary, Tony Severino’s analysis illustrates a pronounced bearish sentiment towards Bitcoin and the cryptocurrency market as a whole. Utilizing the Elliott Wave Theory and various technical indicators, he argues that the market may have reached its peak. Factors contributing to this viewpoint include historical price patterns, market sentiment linked to external events, and signs of declining momentum. Overall, the data suggest significant caution for potential investors in Bitcoin at this time.

Original Source: bitcoinist.com

Post Comment