Market Sentiment Shift: Bitcoin and Ether Decline Ahead of Possible Fed Rate Cuts

Summary

Bitcoin and Ether both declined by 5% as trading commenced this week, with Bitcoin falling below $58,400 amid expectations of Federal Reserve rate cuts. Despite significant inflows into Bitcoin ETFs, the overall market sentiment turned bearish, particularly affecting Ether, which experienced its most significant drop since August. The marketplace is facing increased competition, particularly for Ethereum, as new blockchain initiatives gain traction.

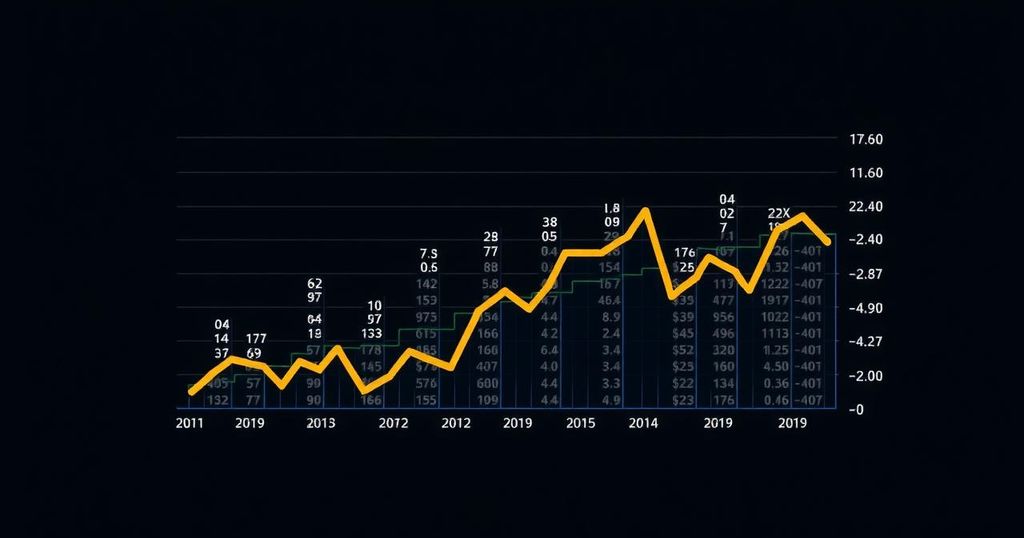

Bitcoin and Ether experienced considerable declines of 5% as the week commenced, with Bitcoin dipping below $58,400 ahead of anticipated interest rate cuts by the U.S. Federal Reserve. On Friday, Bitcoin exchange-traded funds (ETFs) recorded over $263 million in inflows, marking the highest level since late July, while Ether ETFs witnessed more modest inflows of $1.5 million, suggesting ongoing investor engagement with cryptocurrency assets. Despite these positive inflow figures, the general sentiment in the cryptocurrency market turned bearish as trading began on Asian exchanges. Market analysts noted a heightened expectation among traders for the Federal Reserve’s first rate cuts in over four years, which historically tends to bolster bullish sentiment in risk-bearing sectors. According to Polymarket, there exists a 51% likelihood of a 50 basis points cut and a 48% chance of a 25 basis points reduction, with only a 2% expectation of maintaining the current rate. Ether underperformed among major cryptocurrencies, recording a 5.5% drop, its largest single-day decline since August, followed by Cardano’s ADA down 5% and Solana’s SOL dropping 4%. In contrast, BNB Chain’s BNB displayed relatively stronger performance, retreating by only 1.1%. Notably, the token CKB from Nervos surged by 10.5% in the past 24 hours, attributed to favorable market sentiment after its recent listing on the Korean exchange Upbit. Additionally, futures traders, anticipating price increases, faced losses exceeding $143 million amid recent market fluctuations. The BTC/ETH ratio, a key indicator of the relative movements between the two largest tokens, has reached four-year lows, reflecting intensifying competition for Ethereum against rivals such as Solana and the emerging Soneium blockchain from Sony. Сircle recently announced that USDC stablecoin will be integrated into the Soneium ecosystem, although specifics regarding the volume of issuance remain undisclosed.

Recent trends in the cryptocurrency market reveal increased volatility influenced by anticipated policy decisions from the Federal Reserve. Bitcoin and Ether, two of the most prominent digital currencies, are particularly sensitive to macroeconomic indicators such as interest rate adjustments made by the Fed. In recent days, both currencies experienced declines coinciding with market speculation regarding upcoming rate cuts, which traders expect could impact overall liquidity and investment in riskier assets, such as cryptocurrencies. Additionally, movements in exchange-traded funds have been notable, as inflows often signal investor confidence despite broader market challenges. The competition facing Ethereum from newer blockchain technologies and existing rivals, such as Solana, is also a critical factor affecting market dynamics.

In summary, Bitcoin and Ether have faced significant downward pressure as the cryptocurrency market reacts to expectations of impending interest rate cuts from the Federal Reserve. While Bitcoin ETFs saw substantial inflows, the overall sentiment was bearish, particularly for Ether, which recorded its worst decline in recent months. The looming competition from alternative blockchain projects and the evolving landscape of digital finance contribute further to the complexity of market conditions. Investors remain vigilant as the week progresses, holding their breath for the Fed’s decision, which may establish the tone for future trading sessions.

Original Source: www.coindesk.com

Post Comment