Crypto Analyst Predicts 0.50% Fed Rate Cut – Implications and Strategies

Summary

Doctor Profit, a notable cryptocurrency analyst, forecasts a 0.50% interest rate cut by the Federal Reserve on September 18, warning of possible market volatility. He bases this prediction on recent economic improvements, asserting the inadequacy of a smaller cut. Despite short-term uncertainties, he remains optimistic about the market’s stabilization by Q3 2025, advocating for careful risk management and opportunistic trading. The approaching Fed meeting may catalyze significant market movements, notably for Bitcoin.

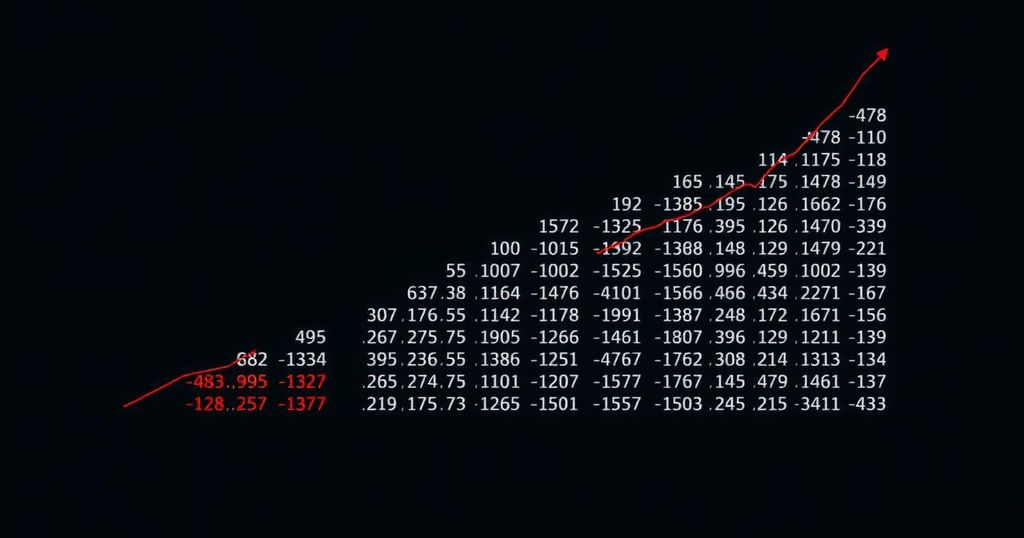

A leading cryptocurrency analyst, known as Doctor Profit, is anticipating that the Federal Reserve will execute a substantial interest rate cut of 0.50% at the upcoming meeting scheduled for September 18. This prediction comes amid a backdrop of market speculation regarding whether the rate adjustment will be a more modest 0.25% or a more assertive 0.50%. Doctor Profit maintains a strong belief in his forecast, citing recent positive trends in the Consumer Price Index (CPI) and Producer Price Index (PPI) that indicate a more favorable economic recovery than previously expected. He contends that a smaller rate cut would be inadequate given the current economic climate, possibly leading to renewed market instability akin to the recent ‘Blood Monday.’ In contrast, a larger rate reduction may provide the necessary support to mitigate market fears and stimulate economic growth. As Doctor Profit examines the volatility that currently characterizes both Bitcoin and traditional stock markets, he suggests that traders brace themselves for dramatic fluctuations. He emphasizes the necessity of prudent risk management strategies to navigate these turbulent waters effectively. Although he expressed confidence in his Bitcoin investments, urging long positions at recent lows around $50,000 and $53,000, he cautions traders to prepare for short-term market manipulations. Looking ahead, Doctor Profit remains optimistic regarding mid-to-long-term market trends, projecting that conditions will stabilize by the third quarter of 2025. He advocates for utilizing panic-induced market dips as potential buying opportunities while emphasizing the importance of establishing stop-loss measures to safeguard against unforeseen declines. As the Federal Reserve meeting approaches, Doctor Profit anticipates that the potential rate cut could catalyze a significant movement in Bitcoin’s market, potentially leading to a breakout as early as October. The prevailing sentiment among analysts suggests that an aggressive monetary policy shift could foster an environment conducive to a resurgence in both cryptocurrency and stock markets, suggesting a need for investors to carefully evaluate their positions in light of impending economic policy changes.

The Federal Reserve’s decisions regarding interest rate adjustments hold profound implications for financial markets, particularly in the realms of cryptocurrency and equities. With the backdrop of fluctuating economic indicators such as the CPI and PPI, many analysts are closely monitoring these developments. Doctor Profit’s predictions underscore the inherent volatility of the markets as investors grapple with uncertainty regarding the Fed’s next steps.

In summary, Doctor Profit’s assertion of a probable 0.50% interest rate cut by the Federal Reserve suggests a critical juncture for market participants. His perspective highlights the need for vigilance in risk management during periods of market volatility while maintaining a long-term optimistic outlook. The anticipation surrounding the Fed’s actions positions investors at a crossroads, prompting critical reflections on their investment strategies as the potential for market reevaluation looms.

Original Source: coinpedia.org

Post Comment