Bitcoin Price Forecast – Bitcoin Continues to Search for Direction

Summary

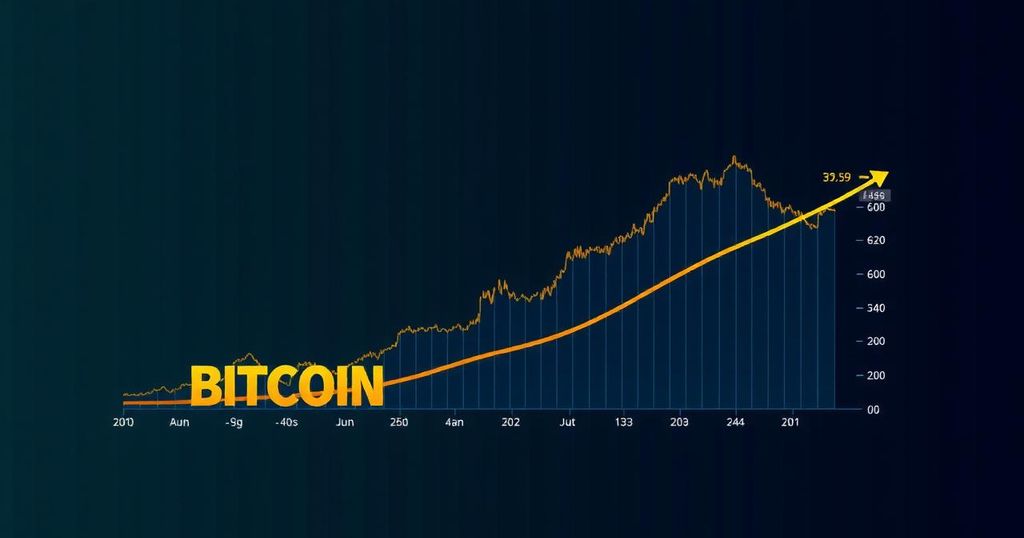

The Bitcoin market is experiencing a period of stagnation, with multiple lower highs since the ETF was released. Currently hovering around $58,000, Bitcoin faces critical levels at $57,500 as support and $60,000 as resistance. A potential drop below $57,500 could lead towards $50,000, while breaking above $60,000 may encourage a rise to $62,000. Investors should maintain a long-term view amid market uncertainties.

The Bitcoin market remains largely stagnant, marked by a series of successive lower highs following the release of the ETF. Current price action reflects indecision, as Bitcoin fluctuates near the $58,000 level. Observations from longer-term charts indicate a downward drift, raising concerns regarding the asset’s viability. The recent price spikes were encouraging, particularly for early investors, yet the focal point now centers on $57,500. The apparent lack of direction in the market suggests that any long positions ought to be considered with a long-term investment mindset, rather than seeking immediate profits. The sustainability of this situation is uncertain, although significant support exists beneath the current price. A breakdown below this area, which includes support and the 200-day exponential moving average (EMA), could see Bitcoin potentially declining to $50,000. Conversely, a daily close above the $60,000 mark may propel Bitcoin towards the next considerable resistance around $62,000. Notably, the recent decline of the U.S. dollar has had little influence on Bitcoin’s performance, warranting further observation.

The discussion surrounding Bitcoin’s price trajectory is nested within the broader context of cryptocurrencies and their historical volatility. The current market dynamics reflect a cautious sentiment among investors, exacerbated by recent fluctuations and external economic indicators. As Bitcoin strives to establish a firm footing amidst these uncertainties, market participants are closely monitoring price levels that have historically functioned as support and resistance. The price action subsequent to the ETF’s release has particularly drawn attention, as it suggests a change in market perception and investor confidence in Bitcoin’s future.

In conclusion, the Bitcoin market is currently characterized by a struggle between support and resistance, with a pronounced downward trend evident in recent price movements. Investors are advised to approach long positions with a long-term perspective, given the uncertainties surrounding the asset. A decisive break below $57,500 could trigger a significant drop, while surpassing $60,000 may open avenues for upward movement towards $62,000. Overall, remaining vigilant of external factors, including movements in the U.S. dollar, is crucial for understanding Bitcoin’s future shifts.

Original Source: www.fxempire.com

Post Comment