Ethereum’s Current Crisis: Navigating the ETH/BTC Freefall

Summary

Ethereum (ETH) faces its largest crisis since 2021, with the ETH/BTC ratio hitting a three-year low. Market dominance continues to shift toward Bitcoin (BTC) amid declining activity on the Ethereum network. A potential market rebound depends on sustained demand, even as analysts warn of possible further price declines.

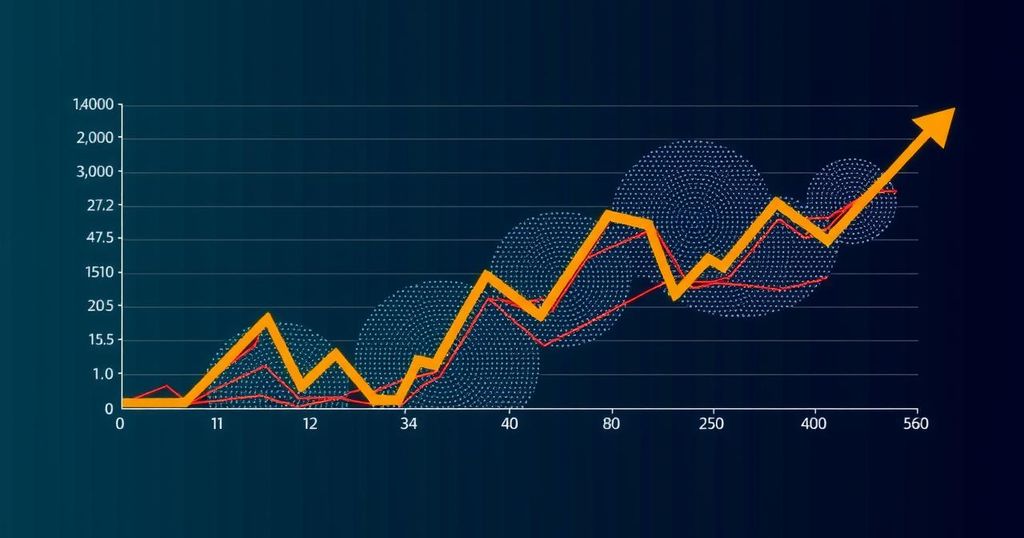

Ethereum (ETH) has recently experienced a significant decline relative to Bitcoin (BTC), with the ETH/BTC trading pair currently at its lowest point in three years. This downturn commenced on July 24, when the ETH/BTC pair fell below a key horizontal trading channel that had been established from May 21 to July 24. The prevailing market sentiment for Ethereum is increasingly pessimistic, with many analysts predicting further declines in its price. The ETH/BTC ratio stands at 0.039, indicating that it now takes significantly more Bitcoin to purchase one Ethereum, a shift that highlights Ethereum’s underperformance compared to Bitcoin. Meanwhile, Bitcoin has managed to anchor its market dominance, now at 57.95%, its highest since April 2021. The increase in Bitcoin’s dominance and the concurrent decline in the ETH/BTC pair suggest a notable loss of market share for Ethereum, further compounded by a decline in network activity on the Ethereum platform. A decrease in network engagement has led to a decrease in the burn rate of Ethereum, resulting in an increased circulating supply. Data from Ultrasound.money indicates that over 70,000 ETH, valued at more than $163 million, has entered circulation in the last 30 days. The growing supply has negatively impacted ETH’s price as it exceeds the prevailing demand. Despite the grim landscape, Ethereum may experience a potential recovery. The upcoming Federal Reserve announcement of a rate cut on September 18 could introduce market volatility. Nevertheless, Ethereum’s Chaikin Money Flow (CMF), which is at 0.12, indicates a potential accumulation trend, suggesting underlying demand for Ethereum. Should this trend continue, Ethereum’s price could rise towards the resistance level of $2,579, with further gains possible should it break this barrier. However, should the demand weaken, a decline towards a recent low of $2,111 would likely ensue, making this a critical period for Ethereum and its investors.

Ethereum, the second largest cryptocurrency by market capitalization after Bitcoin, has been facing significant challenges recently in maintaining its market position. The ETH/BTC ratio is a helpful metric for understanding the relative price performance between these two leading cryptocurrencies. A declining ratio signifies that Ethereum is losing ground compared to Bitcoin. The Ethereum network’s decreased activity has also contributed to pressure on its price, as reduced transactions lead to lower ETH burn rates and increased circulating supply, which can negatively influence market sentiment and pricing.

In summary, Ethereum is currently in a precarious position, facing significant declines against Bitcoin while also grappling with reduced network activity. Although there are signs of potential recovery driven by underlying demand, the outlook remains cautious. Investors are advised to closely monitor market trends, as shifts in demand could substantially impact Ethereum’s price trajectory in the near future.

Original Source: beincrypto.com

Post Comment