Bitcoin ETFs Experience Remarkable Rebound Amid Anticipation of Rate Cuts

Summary

Bitcoin ETFs witnessed a resurgence in investment last week, with $436 million flowing into these products as market expectations shift towards potential interest rate cuts by the Federal Reserve. This recovery follows a challenging period characterized by significant investor withdrawals. Meanwhile, Ethereum funds have not garnered similar interest, facing continued outflows.

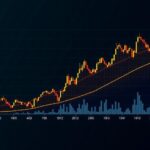

Last week, there was a significant influx of capital into Bitcoin exchange-traded funds (ETFs) and various cryptocurrency investment channels, coinciding with the imminent Federal Reserve meeting. Data compiled by CoinShares, a Jersey-based digital asset manager, indicated that approximately $436 million was invested in cryptocurrency-related funds after a preceding period where investors withdrew $1.2 billion from these markets, marking a shift in sentiment. This recent investment primarily targeted the newly launched American Bitcoin ETFs, introduced by prominent asset managers such as BlackRock, Fidelity, and Grayscale following the approval from the Securities and Exchange Commission (SEC) earlier this year. The launch of these funds was met with enthusiasm, with billions flowing in; however, the latter part of the year saw some outflows as market participants reconsidered their stance on riskier investments due to fluctuating monetary policy expectations from the U.S. central bank. CoinShares noted that the late-week surge in inflows likely stemmed from a modification in market expectations regarding an interest rate reduction of 50 basis points, as hinted by former New York Fed President Bill Dudley. As the Federal Open Market Committee convenes Tuesday and anticipates a decision on the nation’s current interest rates, which are at their highest in 23 years, investors remain hopeful for a rate cut. The market’s response may well hinge on how substantial this reduction proves to be, particularly in relation to “risk-on” assets like Bitcoin. Furthermore, CoinShares observed continued challenges for Ethereum-focused funds, which experienced a cash outflow of $19 million despite the SEC’s approval of Ethereum ETFs in May. Conversely, funds related to Solana, the fifth largest cryptocurrency, have shown a positive trend, garnering $3.8 million for the fourth consecutive week.

The current state of Bitcoin ETFs and cryptocurrency investment is heavily influenced by regulatory changes and market sentiment influenced by the Federal Reserve’s monetary policy. Recently, investors had been withdrawing significant sums from cryptocurrency funds, indicative of a bearish trend regarding speculative assets. However, in the face of expectations for potential interest rate cuts, there has been a reversal in investment patterns, particularly concerning Bitcoin ETFs. The financial strategies and risk assessments of major asset management firms such as BlackRock and Fidelity play a crucial role in shaping market dynamics and influencing investor behavior.

In conclusion, the landscape for Bitcoin ETFs has notably transformed as investors seek refuge from bearish trends amidst changing monetary policy expectations. The latest inflows represent a significant rebound in confidence, primarily attributed to anticipated interest rate cuts by the Federal Reserve, which may encourage further investment in volatile assets such as Bitcoin. Conversely, Ethereum funds continue to struggle, illustrating the varying levels of interest among digital assets. Investors appear cautiously optimistic as they await the Federal Reserve’s announcement regarding rates, which will undoubtedly shape future investment strategies.

Original Source: decrypt.co

Post Comment