Bitcoin Price Experiences Decline Ahead of Potential Fed Rate Cuts

Summary

Bitcoin (BTC) saw a 2.7% decline over the past day amid expectations of upcoming U.S. Federal Reserve rate cuts. Current market sentiment suggests that while rate cuts typically promote risk assets, economic uncertainties may inhibit their positive impact. The approaching U.S. Presidential Elections could further influence Bitcoin’s future value, with predictions varying based on the election outcome.

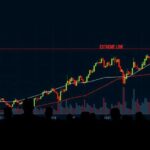

Bitcoin (BTC) experienced a decline of 2.7% within the past 24 hours, hovering around $60,000 during the weekend. This decrease coincides with the U.S. Federal Reserve (Fed) preparing for a long-anticipated rate-cut cycle expected to commence this week. Notably, this development aligns with the predictions set forth by former BitMEX CEO, Arthur Hayes. If the Fed proceeds with rate cuts as anticipated, it will mark the first reduction in four years, following the tightening measures instituted to combat rising inflation that resulted from the COVID-19 pandemic and related economic challenges. Currently, betting platforms such as Polymarkets indicate a 57% likelihood of a 50 basis point cut, with a 42% probability for a 25 basis point reduction. Traditionally, rate cuts are perceived as favorable for risk assets, as they reduce borrowing costs for businesses, thus stimulating growth and encouraging investment in higher-risk assets, including cryptocurrencies. However, this time, analysts express skepticism about whether such rate cuts will have the usual positive effect on assets like Bitcoin. Some experts suggest that rate cuts amid economic uncertainty, particularly in light of elevated unemployment figures, may signal to investors that the Fed is acting out of necessity rather than confidence in economic resilience. Furthermore, there is a possibility that behaviors surrounding the announcement could reflect a ‘buy the rumor, sell the news’ scenario, where investors inflate prices in expectation of the cuts only to sell before the actual event to secure profits. Concerns regarding inflation persist, despite lower-than-expected Consumer Price Index (CPI) results for August 2024; the core CPI indicates that inflation remains a significant concern, potentially dampening the impact of the Fed’s anticipated monetary easing. Looking ahead, the U.S. Presidential Elections loom as a pivotal factor that could significantly influence cryptocurrency markets. Support from Republican candidate and former President Donald Trump for the crypto sector raises the prospect that if he were to reclaim the presidency, Bitcoin’s value could soar to as much as $90,000 by Q4 2024. Conversely, a victory for Kamala Harris could drive Bitcoin prices low, potentially down to $30,000. As of now, Bitcoin is trading at approximately $58,498, reflecting a 2.7% decrease in the last 24-hour period.

The ongoing fluctuations in Bitcoin’s value are significantly linked to macroeconomic factors, particularly the monetary policies of the U.S. Federal Reserve. Following substantial monetary stimulus introduced during the COVID-19 pandemic, the Fed has been managing inflation through a series of rate hikes since March 2022. As the Fed approaches potential rate cuts, the dynamics of how these changes influence risk assets, such as Bitcoin, are under scrutiny. Historically, lower interest rates are associated with increasing asset values; however, current economic uncertainties pose questions about investor sentiment in this context.

In summation, Bitcoin’s recent price drop of 2.7% is indicative of broader market anxieties surrounding upcoming rate cuts by the Federal Reserve. With the prospect of reduced borrowing costs approaching, uncertainties remain about their efficacy in buoying risk assets amidst economic challenges. Notably, the forthcoming U.S. Presidential Elections may also shape market trajectories, with potential volatility based on the election outcome. Investors are advised to remain vigilant as both macroeconomic indicators and political developments unfold.

Original Source: bitcoinist.com

Post Comment