Challenging Financial Media Narratives: The Resilience of Stocks Amid Rate Cuts

Summary

The article critiques the pervasive fear mongering in financial media surrounding the Federal Reserve’s impending interest rate cuts, asserting that historical data contradicts the idea that such cuts lead to stock market disasters. Instead, it highlights that following rate cuts, particularly over extended periods, stock market performance has generally been positive, with the S&P 500 yielding an average annual return of 9.5%. The analysis reveals that while there may be short-term volatility, substantial long-term gains can emerge, presenting opportunities for informed investors.

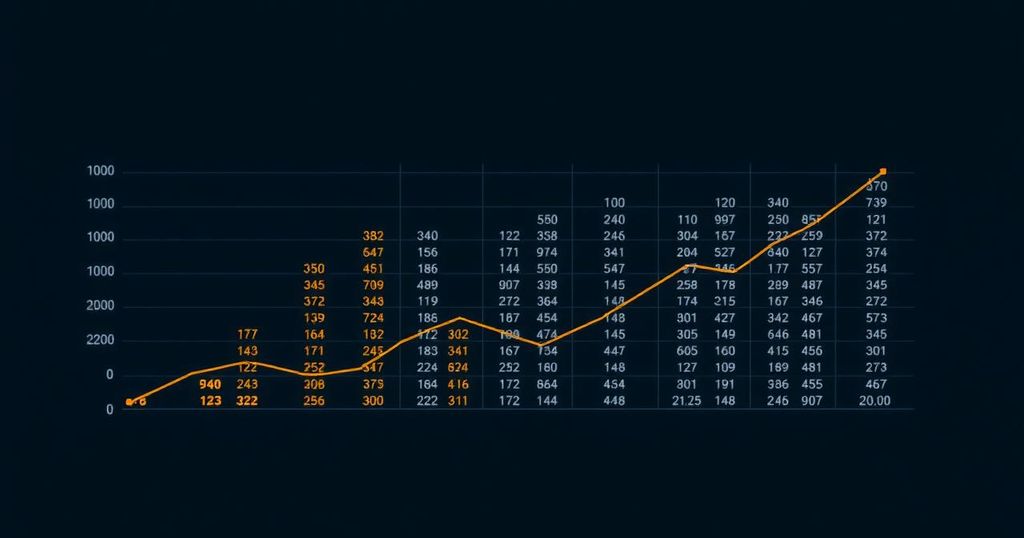

In recent times, sensationalistic fears dominate financial news, often predicting economic disasters, especially around the anticipated Federal Reserve’s interest rate cuts. Critics urge investors to divest from stocks, asserting that rate cuts signify a downturn. Yet, historical data suggests otherwise. Since 1928, the S&P 500 has generally yielded positive returns following initial interest rate reductions. This trend emphasizes that while naysayers present complex arguments, it is often the optimists who realize profits. Over the long term, especially during periods of interest rate easing, the S&P 500 has shown resilience; with average returns of 9.5% annually, several periods following rate cuts reveal significant gains. Analyzing nine past monetary easing cycles over the last fifty years, it became evident that although there may be mild declines initially, substantial gains typically follow. This pattern illustrates that rate cuts do not herald disaster for risk assets. Instead, adverse market reactions can present opportunities for strategic investors, suggesting that a buy-and-hold approach to equities and cryptocurrencies can yield above-average returns in the subsequent years.

The article addresses the recent trend in financial media to project a doomsday narrative, specifically regarding the Federal Reserve’s forthcoming interest rate cuts. The author illuminates the misconception that such monetary policy changes invariably lead to significant stock market declines. Rather, through extensive data analysis dating back to 1928, the article aims to provide a robust argument that suggests a historical trend of resilience and growth following rate cuts.

In closing, the article underscores the importance of staying informed through empirical data rather than succumbing to fear-driven narratives prevalent in financial media. It illustrates that while initial reactions to Federal Reserve interest rate cuts may prompt panic, historical patterns indicate that the following years typically yield remarkable returns for investors in equities and cryptocurrencies. Thus, strategic investors may find opportunities amidst market volatility, leveraging adverse conditions to enhance their portfolios, reflecting on the adage that fear often sells more than reasoned optimism.

Original Source: www.coindesk.com

Post Comment