Understanding Bitcoin to USD Conversion and Market Dynamics

Summary

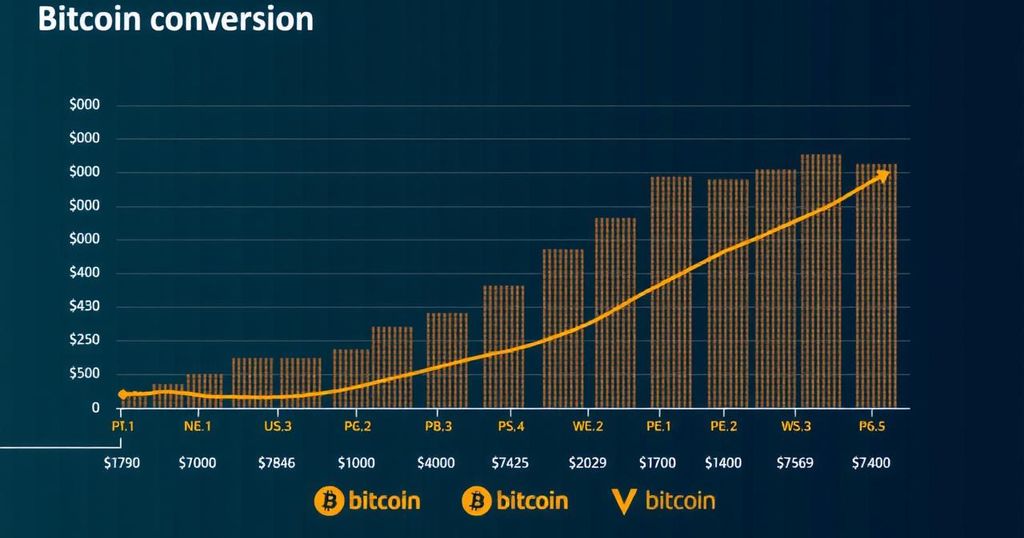

Cryptocurrency, particularly Bitcoin (BTC), has become a widely traded asset due to its decentralized nature and capped supply. To convert BTC to USD, one can utilize tools like the Forbes Advisor Currency Calculator. The current Bitcoin to USD exchange rate fluctuates, impacting buying and selling strategies. Investors should also be mindful of the legal implications surrounding taxes when transacting in cryptocurrencies. Bitcoin’s history and regulatory environment are key factors influencing its market value.

Cryptocurrency has significantly surged in popularity, with Bitcoin as the foremost and most esteemed option among global investors. Notably, Bitcoin (BTC) operates as a decentralized digital currency, transacted and regulated through a peer-to-peer network. Its circulation is capped at a maximum of 21 million bitcoins, anticipated to be fully mined by 2140. Each bitcoin is encoded with a unique transaction history and is securely stored in a digital wallet, facilitating seamless transfers in exchange for goods and services while offering a degree of anonymity. The classification of Bitcoin remains under discussion, with opinions divided on whether it functions as a currency, a commodity, or a hybrid.

Bitcoin is often heralded as the original cryptocurrency, introduced in 2009 by an individual or group under the alias of Satoshi Nakamoto. Initially, its value was determined through user-influenced forums, evolving significantly once the first exchange platforms surfaced. Today, Bitcoin is accepted by over 1,000 merchants worldwide, emphasizing its adoption as a practical currency. With the growth of trading platforms, understanding the conversion process from Bitcoin to United States Dollars (USD) is crucial for investors. Navigating the complexities of cryptocurrency trading requires awareness of market fluctuations and legal considerations, such as taxation.

In conclusion, Bitcoin stands as a vital asset in the cryptocurrency landscape, necessitating diligent research by investors to make informed decisions regarding conversions and investments. Utilizing platforms like the Forbes Advisor Currency Calculator can simplify the process of determining transaction values. Moreover, understanding the regulatory framework surrounding the taxation of cryptocurrency sales is essential for compliance and effective asset management. Investors are encouraged to stay updated on market trends to optimize their trading strategies in BTC.

Original Source: www.forbes.com

Post Comment