Bitcoin Surges Past $62,000 Amid Federal Reserve Rate Cut, $60,000 Remains Critical

Summary

Bitcoin recently surged past $62,000 following a substantial interest rate cut by the Federal Reserve, its first in over four years. Ethereum also saw gains but lagged behind Bitcoin’s performance. The market experienced significant liquidations of contracts, reflecting shifts in trader positions amidst the price increases. Analysts emphasize the importance of the $60,000 level as a critical battleground for future price movements.

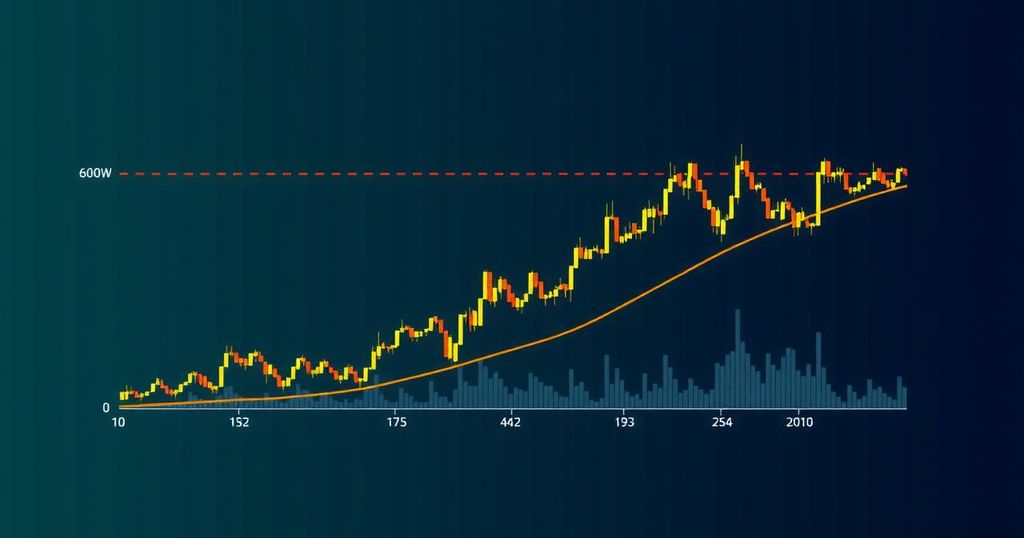

On Thursday morning, Bitcoin witnessed a notable surge, surpassing the $62,000 threshold, reaching as high as $62,190, in the wake of the Federal Reserve’s announcement of a significant rate cut. Ethereum, while observing a 5% increase to $2,435, lagged behind Bitcoin, which demonstrated greater momentum over the same two-week period. Following the Federal Reserve’s interest rate decision, Bitcoin’s price exhibited volatility, initially climbing to $61,300 before falling to $59,400. However, bullish sentiment soon prevailed, driving the price to peaks of $62,500 before a minor pullback occurred. The broader cryptocurrency market experienced gains alongside Bitcoin, resulting in considerable liquidations among derivatives traders. In the past 24 hours, approximately $204.3 million worth of contracts were liquidated, with $130.5 million attributed to short positions—those betting against market price—and $73.8 million from long positions, underscoring a shift in market sentiment amid rising prices. The Federal Reserve’s recent rate cut marked its first in over four years, a move that surprised many analysts who had anticipated a more conservative reduction of 25 basis points. The 50-basis point cut reflects a robust approach to easing monetary policy, aligning with investors’ expectations for more proactive measures in light of prevailing economic uncertainties. According to Alex Kuptsikevich, senior market analyst at FxPro, this enhanced risk appetite post-Fed’s decision has facilitated recent highs in the cryptocurrency markets. He further elaborated that the crypto space has been navigating within a downward corridor since mid-March, and overcoming the recent peak of approximately $2.25 trillion would be essential to altering this trajectory. Commentators have noted that Bitcoin may encounter formidable resistance around the $64,000 level, which aligns with the 200-day moving average. Chris Aruliah, Head of Institutional at Bybit, emphasized that historically, rate cuts have often catalyzed increased capital inflow from banks into riskier assets, including cryptocurrencies. Nonetheless, he cautioned against potential headwinds stemming from economic volatility. On-chain analysis further indicates that Bitcoin’s price dynamics are affected by the behavior of short-term holders, who have previously signaled support or resistance levels. Avinash Shekhar, co-founder and CEO of Pi42, discussed the trend of short-term holders selling since August, suggesting a potential price bottom may be forming, while long-term holders have continued to maintain a support level above $60,000. This scenario has set the stage for a competition between bullish and bearish sentiments within the market. He asserted, “A high above $62K can usher in bullish momentum, while a breakdown below $60K could extend selling pressure.”

The rise in Bitcoin’s price comes in the context of recent economic developments, specifically the Federal Reserve’s decision to cut interest rates. Rate cuts are often perceived favorably by investors, especially in riskier asset classes like cryptocurrencies, as they may lead to lower borrowing costs and boost demand for investments. The cryptocurrency market has been marked by volatility, driven in part by macroeconomic factors, and analysts are closely monitoring critical price levels in the wake of significant monetary policy changes. Understanding the interplay between Bitcoin’s price, interest rates, and investor behavior provides crucial insight into current market dynamics.

In summary, Bitcoin’s price has surged past the $62,000 mark in response to the Federal Reserve’s unexpected and significant interest rate cut. Analysts view the $60,000 level as a critical battleground, with the potential for upward momentum if this threshold is maintained. Conversely, failure to uphold this support may result in increased selling pressure. As the economic landscape continues to evolve, Bitcoin and other cryptocurrencies remain subject to market fluctuations influenced by macroeconomic policies and investor sentiment.

Original Source: decrypt.co

Post Comment