Ethereum Price History and Its Relationship with DeFi and NFTs

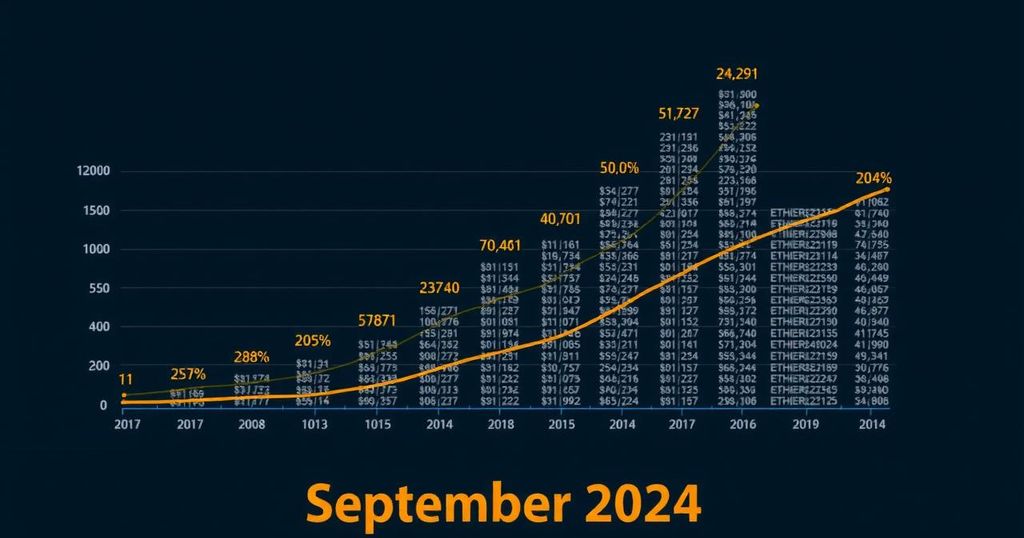

As of September 19, 2024, Ethereum’s price history reveals its intricate relationship with the DeFi industry and the rise of NFTs. DeFi, leveraging technology to remove intermediaries, significantly impacts Ethereum’s value, as does the growth of NFTs, which utilize Ethereum’s blockchain for various applications. Recent data highlights Ethereum’s market fluctuation, with a price of $2,464.75, illustrating the dynamic nature of cryptocurrency values.

The historical price movements of Ethereum (ETH) have been closely intertwined with the burgeoning Decentralized Finance (DeFi) industry as of September 19, 2024. DeFi leverages technology to eliminate intermediaries in financial transactions, fostering the growth of various applications like crypto wallets, Uniswap, and stablecoin issuer Maker. Unlike traditional cryptocurrencies such as Bitcoin and Ripple, Ethereum operates as an open-source software platform enabling blockchain applications, wherein Ether acts as the native currency. This differentiation underscores Ethereum’s pivotal role in facilitating DeFi innovations, suggesting that its price performance is significantly influenced by the success of this sector. Furthermore, the popularity of Non-Fungible Tokens (NFTs), which experienced rapid growth from 2018 to 2020, showcases another fundamental application of Ethereum’s technology. NFTs represent unique digital assets secured on the blockchain, with significant relevance in domains such as crypto art, gaming, and collectibles, thereby expanding Ethereum’s use cases beyond just financial transactions. In recent Ethereum price data, as of September 19, 2024, the value stood at $2,464.75, reflecting a fluctuating market with values ranging from $2,274.11 to $2,441.61 in the preceding days. This volatility illustrates the dynamic nature of the cryptocurrency market, particularly for Ethereum, which operates amid the rapidly evolving landscapes of DeFi and NFTs.

Ethereum is recognized not merely as a cryptocurrency but as a versatile platform that supports a variety of applications including smart contracts and decentralized applications (dApps). The platform’s architecture allows for the execution of smart contracts, which are self-executing contracts with terms directly written into code. This capability has led to the rise of DeFi, a sector focused on recreating and improving traditional financial services through blockchain technology, offering services like lending, borrowing, and trading without intermediaries. The significant growth of this sector, combined with Ethereum’s technological features, encapsulates its fundamental value proposition in the crypto ecosystem. Additionally, NFTs have opened new avenues for ownership and digital rights within various entertainment and cultural industries, further cementing Ethereum’s relevance in the market.

In conclusion, Ethereum’s future is intricately linked with the evolution of the DeFi sector and the expanding realm of NFTs. Its unique position as a technological platform encourages continuous innovation that not only enhances its utility but also influences its economic value. This entwining of technological advancement and market performance is critical in understanding Ethereum’s trajectory, which has shown notable price movements reflective of broader industry trends.

Original Source: www.statista.com

Post Comment