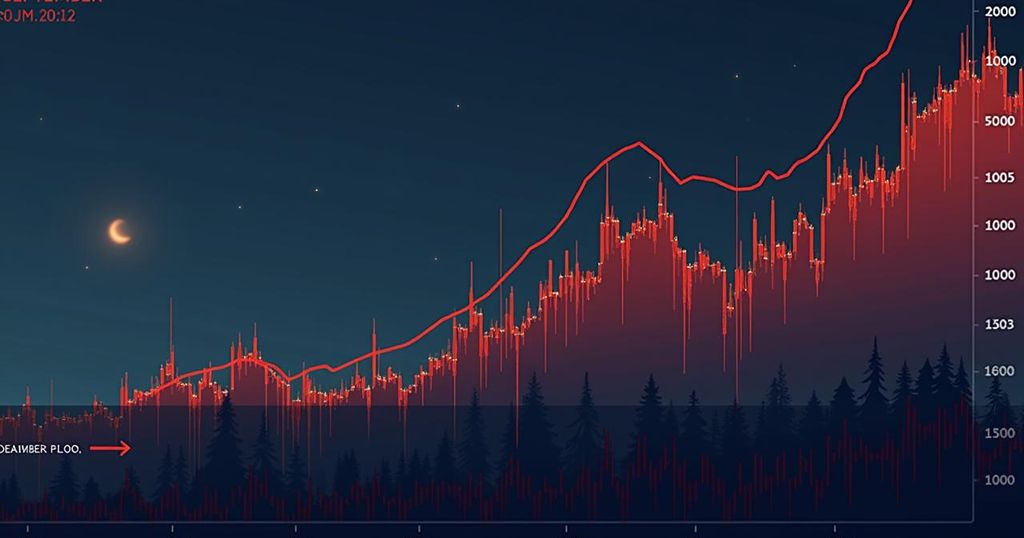

Bitcoin’s Bullish Trajectory: A 9% Gain in September and the Promise of October

Bitcoin is on track to post a 9% gain in September, defying historical trends. This performance bodes well for October, a typically bullish month for BTC, with projections targeting $70,000 from current levels. Global monetary policies, institutional investments, and favorable political sentiment are contributing to an optimistic outlook for the cryptocurrency market as the seasonal trends suggest continued growth.

Bitcoin (BTC) is poised to conclude September with a remarkable gain of at least 9%, marking its most successful performance for this month since 2013. This trend contradicts its historical norm of negative returns during September, with only two previous months displaying positive growth in the past decade. The upcoming month of October typically augurs well for the cryptocurrency, as it has experienced only two down months since 2013, with gains reaching as high as 60% and averaging around 22%. This year’s positive performance in September not only challenges Bitcoin’s recent historical downturn but also sets the stage for anticipated price increases in October, November, and December. As investors eye a potential surge toward $70,000 from the current $64,000, the seasonal bullish sentiment around Bitcoin appears to be gathering momentum. Several factors are underpinning this bullish outlook, including global monetary easing policies, a weakening yen, and increased interest from institutional investors. Political sentiment within the United States also seems to be favoring the cryptocurrency market as upcoming elections loom. These ingredients suggest that the current bullish trend has the potential for sustainability. Augustine Fan, head of insights at SOFA, states, “With crypto correlations staying high to macro assets, particularly against the SPX, we consider the friendly macro background to remain a strong tailwind for crypto prices into Q4.” He further notes, “We remain bullish on price action in the near term, with targeted put-selling strategies likely to be popular as investors switch into a ‘buy-the-dip’ mode.”

The performance of Bitcoin is characterized by seasonal trends that have been observed over the years. September has typically been Bitcoin’s weakest month, averaging a loss; however, the cryptocurrency market experiences recurring fluctuations associated with broader economic cycles and investor behavior. Historically, October has signaled a bullish period for Bitcoin, characterized by rapid price increases. Any alterations in global monetary policies, investor sentiment, or political influences can significantly sway Bitcoin’s trajectory in the market. This year’s unusual gain in September suggests a deviation from the norm, leading to speculation about favorable conditions for an upward price trend in October.

In summary, Bitcoin’s unexpectedly strong performance in September, exhibiting a gain of 9%, defies its usual trend of decline and sets a positive tone for October, a month historically marked by appreciation in cryptocurrency values. Influencing factors such as supportive macroeconomic conditions and institutional interest are bolstering investor confidence, suggesting potential upcoming gains toward significant price targets. The anticipation for a bullish October is heightened by rising sentiment across political and monetary policy spheres, indicating a possible extended rally for Bitcoin in the closing months of the year.

Original Source: www.coindesk.com

Post Comment