Bitcoin Price Outlook: Navigating the $60,000 Support Level

The Bitcoin market is focusing on the $60,000 mark as a critical support level, aiming to establish a potential floor while showing signs of a modest rally. Despite institutional backing, concerns linger over Bitcoin’s long-term utility and adoption as a payment method, casting a bearish outlook on its future prospects. Technical analysis indicates possible rebounds, but broader economic acceptance remains a question mark.

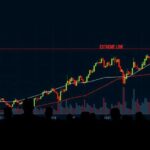

The Bitcoin market is currently fixated on the $60,000 threshold, regarded as a significant support level. Recent movements indicate a modest rally in the early hours of Thursday, which suggests an attempt to establish a solid floor at this price point. Market sentiments appear to be aiming for a reaffirmation of the previous rally. However, upon reviewing price trends since the announcement of the ETF, it could be argued that Bitcoin is forming what resembles a bullish flag; nonetheless, this interpretation may be overly optimistic given the prevailing market conditions. The potential for a rounding bottom exists, which could indicate a subsequent upward movement. However, the market’s struggle for momentum remains evident. Given Wall Street’s prominent role in Bitcoin trading, particularly with substantial purchases made by entities such as BlackRock, it appears that there is a degree of stability, yet a tangible upward momentum is lacking. This situation suggests a gradual and steady trading environment favored by institutional investors. Despite the technical analysis indicating this cautious optimism, I hold a bearish outlook on Bitcoin in the long run. While the cryptocurrency is often posited as a solution to various economic challenges, concrete evidence of its widespread adoption in mainstream economies remains elusive. Personal observations reveal a lack of establishments accepting Bitcoin payments within a large metropolitan area of approximately five million residents. Thus, it seems that the current utilization of Bitcoin is largely by Wall Street, serving more as a proxy for traditional bonds rather than as a widely accepted currency. Currently, if the price rebounds from the $60,000 level, significant attention should be paid to the $62,000 and subsequent $65,000 levels. Conversely, should Bitcoin drop below $60,000, the next critical support level would be $57,500, representing a more substantial backing for the asset. The concept of decentralized ledger technology, though not novel in its essence, is still not achieving the expected adoption necessary for broader economic integration.

Bitcoin, a decentralized digital currency, has been a focal point of financial discussions, particularly following significant institutional interest, including substantial investments from major asset managers such as BlackRock. Despite its growing presence in the financial landscape, skepticism remains regarding its long-term viability and mainstream acceptance as a method of payment. This tension between institutional trading practices and the expected utility of Bitcoin is central to understanding the current market dynamics surrounding the cryptocurrency.

In summary, the Bitcoin market is currently observing significant activity around the $60,000 support level. While institutional investments provide a semblance of stability, the lack of broader adoption and tangible momentum raises questions about its long-term prospects. The market appears to be at a crossroads, grappling with its identity within the financial ecosystem while attempting to establish a clearer path forward. Technical indicators suggest possible upward movement, but the underlying fundamentals indicate a need for caution and critical evaluation of Bitcoin’s future as a widely accepted currency.

Original Source: www.fxempire.com

Post Comment