Bitcoin Price Faces Correction Risk as Open Interest Surges Amid Low Trading Volume

Analysts warn of a potential Bitcoin price correction as futures market open interest rises to new highs, while trading volume declines. This imbalance exposes the market to risks of sudden reversals, particularly if traders begin liquidating long positions. Technical indicators suggest resistance at $68,000, and external political factors further influence market sentiment, creating a volatile environment.

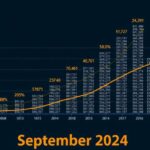

Recent analyses suggest that the Bitcoin market is facing a potential price correction due to rising open interest in futures, coupled with a significant decline in trading volume. As open interest hits record highs, experts caution that the disparity between this increase and lower market participation may lead to sudden and sharp reversals, particularly if leveraged traders begin liquidating their long positions. Illia Otychenko, the Lead Analyst at CEX.IO, indicated that open interest has reached peaks not seen since earlier in the year, while funding rates are at their highest since June. He expressed concerns regarding the decrease in trading volume, stating, “The troubling part is the downtrend in volume. This means fewer traders are actively participating, but those that remain are heavily leveraged. The market is becoming fragile, and any loss of momentum could trigger a swift correction.” The volatility in Bitcoin’s price was evident recently, where it surged to $67,922 before swiftly dropping to $65,160, resulting in liquidations amounting to $302.25 million in leveraged positions. Following this downturn, Bitcoin experienced a slight recovery, trading at approximately $67,120. Analysts further highlight that Bitcoin’s current market conditions present heightened sensitivity to changes in sentiment, due to the mismatch between open interest and trading volume. Otychenko warned, “A drop in volume while leverage rises is a red flag—it creates an environment where even small price changes can spark liquidation cascades. If traders start locking in profits, especially on long positions, the market could unravel quickly.” The cryptocurrency is also encountering resistance at the $68,000 mark, a price point that has proven challenging to surpass. Technical indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) signify potential weaknesses, reflecting bearish divergences. Moreover, institutional flows remain robust, as highlighted by analyst Valentin Fournier of BRN, who noted, “Institutional support remains strong, with $371 million in ETF inflows yesterday. The Fear and Greed Index has risen to 73, reflecting growing confidence among market participants. However, the market is now at a critical juncture—either we see a breakout soon, or the selling pressure could build, forcing a correction.” Political factors may also play a role in Bitcoin’s volatility, particularly as Donald Trump’s probability of winning the 2024 presidential election has risen, influencing market sentiment and investor strategies. Otychenko remarked that election outcomes may introduce additional risks prompting adjustments in traders’ positions. The ongoing fluctuations in Bitcoin’s price dynamics underscore the complex interplay of market sentiment, technical indicators, and external socio-political variables influencing the future trajectory of this leading cryptocurrency.

The cryptocurrency market, particularly Bitcoin, is characterized by a unique set of dynamics that are influenced not only by market activities and trader behaviors but also by external macroeconomic and political factors. Currently, Bitcoin is experiencing heightened levels of open interest in futures trading, which indicates increased speculative activity. Nonetheless, a corresponding drop in trading volume raises alarms about market sustainability and the potential for abrupt price corrections. Technical indicators are also being closely monitored for signs of strength or weakness, adding another layer of complexity to market analysis.

In conclusion, the Bitcoin market stands at a critical junction, with rising open interest and declining trading volume posing significant risks for price corrections. Analysts emphasize the need for traders to be cautious, as the current conditions reflect a fragile market vulnerable to sudden shifts in sentiment and profit-taking. The interplay of institutional support, technical indicators, and external political dynamics further complicates the outlook, making vigilant monitoring essential for investors and market participants alike.

Original Source: decrypt.co

Post Comment