Bitcoin Reaches Ten-Week High: Institutional Interest and Whale Accumulation Fueling Growth

Bitcoin has reached a ten-week high above $67,000, driven by a significant rebound in demand comprising 177,000 BTC largely attributed to institutional interest and whale accumulation. Recent USD purchases via spot ETFs and historical seasonal performance trends have further bolstered the market, suggesting a potential for continued growth despite cautionary notes regarding external regulatory influences.

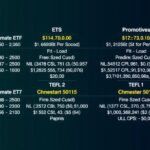

Bitcoin (BTC) has recently experienced a notable resurgence in demand, propelling its price to reach a ten-week high of over $67,000, as reported in the latest weekly analysis from CryptoQuant. Notably, there was an increase of approximately 177,000 BTC in apparent demand last week, marking the largest growth observed since April. This surge has contributed to a 5% rise in Bitcoin’s price, which currently stands at $67,800, instilling renewed optimism among investors following a prolonged slump since May. The revival of interest in the cryptocurrency market can primarily be attributed to significant institutional activity, heightened whale accumulation, and favorable seasonal factors. A particular highlight noted in the report is the influx of investments via spot exchange-traded funds (ETFs) in the United States, which recorded the highest daily purchase volume, with nearly 8,000 Bitcoin acquired recently. Spot ETFs have contributed to a trend where an average of 9,000 Bitcoin has been purchased daily in the first quarter of 2024, acting as a critical catalyst for the observed price escalation. The increase in institutional inflows suggests a reawakening of confidence in the cryptocurrency sector, especially given the anticipation of regulatory approvals for additional spot Bitcoin ETFs. Concurrently, large investors, commonly referred to as “whales,” have been consistently accumulating Bitcoin, with their collective holdings rising to 670,000 BTC, a figure that exceeds the 365-day moving average. This behavior indicates a solid belief in sustained long-term price appreciation. Furthermore, Bitcoin’s uptick aligns with historical trends observed in the fourth quarter of halving years, which have historically proven favorable for the cryptocurrency’s value. In previous halving years of 2012, 2016, and 2020, Bitcoin experienced significant price increases in the last quarter, suggesting a bullish outlook for Q4 2024 as well. As of the current reporting time, Bitcoin holds the position of the top cryptocurrency by market capitalization, with a valuation of $1.34 trillion and a 24-hour trading volume of $43.92 billion. The broader cryptocurrency market is estimated at $2.32 trillion, showcasing an overall revival in digital assets, spurred by the factors driving Bitcoin’s recent performance.

In recent months, Bitcoin’s market performance has been characterized by periods of low activity and investor hesitance. However, recent data indicates a shift, with substantial interest reinvigorating the market. This activity can largely be traced back to increased involvement from institutional investors and large-scale investors, or ‘whales,’ who have historically been crucial to Bitcoin’s price movements. The analysis provided by CryptoQuant helps to contextualize these changes within broader market trends and historical performance, particularly concerning seasonal factors that historically influence Bitcoin’s price during certain times of the year.

In summary, Bitcoin has successfully initiated a rally towards a ten-week high due to a combination of institutional demand, whale accumulation, and historically favorable seasonal patterns. With an increase in day-to-day purchases from spot ETFs and a significant accumulation by large investors, the cryptocurrency appears poised for continued growth. However, external challenges, including potential regulatory impacts, could introduce volatility in the near future, necessitating ongoing observation of market trends.

Original Source: cryptoslate.com

Post Comment