Bitcoin (BTC) Poised for Success as Profitability Surges Among Holders

Bitcoin (BTC) has experienced a 10% price surge, placing 95% of its holders in profit. After initial declines in October, the cryptocurrency has rebounded, with key metrics indicating a strong potential for further gains. The analysis forecasts a possibility of reaching $78,000, despite inherent market risks that could lead to corrections.

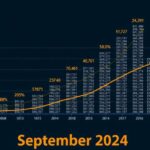

Bitcoin’s (BTC) recent price performance, marked by a 10% increase over the last week, has significantly benefited its investors, with approximately 95% of holders currently enjoying profitability. This bullish trend positions Bitcoin favorably as it approaches the $78,000 mark, indicating the potential for a new all-time high. In October, Bitcoin’s journey commenced with some turbulence, witnessing a decline from $63,000 to below $59,000. However, since the middle of the month, the cryptocurrency has regained momentum, reinforcing optimistic projections for a vigorous end to October. An analysis using the Global In/Out of Money (GIOM) metric reveals that only 994,100 addresses, which collectively hold about 630,000 BTC, are experiencing unrealized losses. This figure demonstrates a stark contrast against the multitude of addresses currently in profit, suggesting a robust bullish trend may be on the horizon. Furthermore, the Market Value to Realized Value (MVRV) ratio implies that Bitcoin could soon reach values of approximately $78,143. Currently, Bitcoin has successfully broken out of the descending channel it was confined to since March. The Awesome Oscillator (AO), a valuable technical analysis tool, confirms this upward trend by indicating a positive reading that reflects improving momentum. Should this trend continue, Bitcoin’s price may rise by approximately 14.25%, potentially topping at $78,000. However, it is pivotal to note that any sudden selling pressure could result in a price correction back to around $62,555.

This article discusses the recent performance of Bitcoin (BTC), focusing on its price surge that has resulted in majority profitability for its holders. With the cryptocurrency demonstrating a notable rebound after early October fluctuations, the analysis leverages market metrics such as Global In/Out of Money (GIOM) and Market Value to Realized Value (MVRV) to forecast future price movements. It also touches upon technical indicators, such as the Awesome Oscillator (AO), cementing its analysis with historical context and predictive insights regarding Bitcoin’s trajectory towards hitting new price milestones.

In summary, Bitcoin’s recent price increase positions it favorably for potential new highs, with a significant portion of holders currently in profit. Utilizing critical analysis tools such as GIOM and MVRV, the outlook remains bullish, suggesting probable ascending price movements towards $78,000. However, vigilance is warranted, as market volatility could introduce sudden price retracements.

Original Source: beincrypto.com

Post Comment