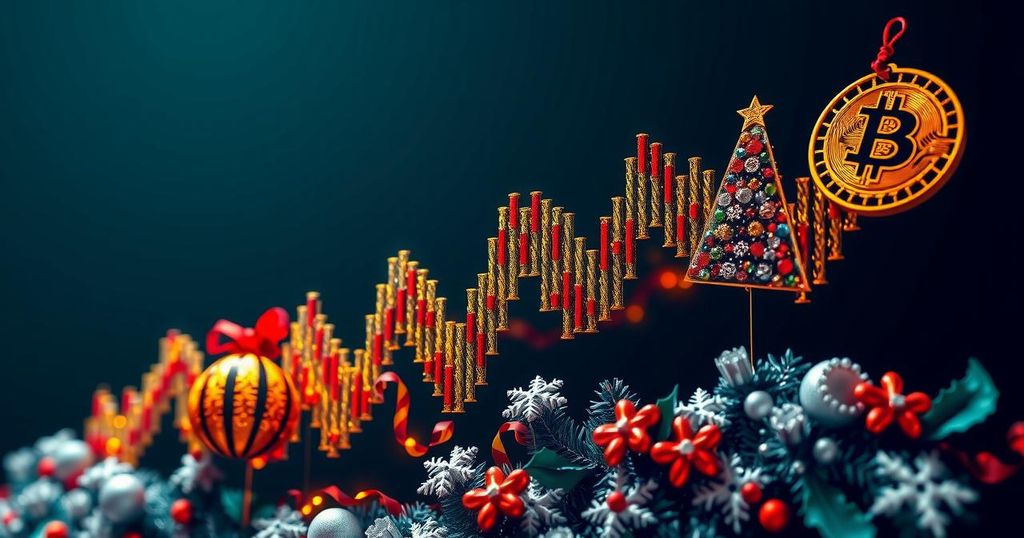

Bitcoin Market Analysis: Impact of Shorts and ETF Inflows on Price Dynamics

Bitcoin’s market remains predominantly bullish, supported by record ETF inflows and persistent exchange outflows. However, negative funding rates and a surge in short positions indicate potential volatility. Market dynamics may lead to a short squeeze, causing price fluctuations as traders respond to changing sentiment and levels of activity.

As of the latest updates, Bitcoin has demonstrated notable resilience, with bulls maintaining control even as the cryptocurrency reached new heights. This steadiness has been observed despite a perceived overbought market and speculation about potential sell-offs following recent all-time highs. Confidence in the cryptocurrency market remains elevated, supported by significant inflows into Bitcoin exchange-traded funds (ETFs). In the latest reporting period, Bitcoin ETFs recorded an unprecedented inflow of $1.4 billion in a single day, which further reinforces market optimism. An analysis by cryptoQuant highlights the emerging dynamic of shorts operating within the Bitcoin market. While the open interest remains significant, funding rates have turned negative—a trend that frequently signifies a bearish sentiment among traders. The prevailing data reveals an increase in short positions, driven by expectations that the recent Bitcoin peak may act as a resistance level. Should Bitcoin’s price ascend further, short positions could be inviting liquidation events, potentially fueling a sudden upward price movement known as a short squeeze. Moreover, exchange flow statistics illustrate that, despite recent decreases in overall activity, the outflow of Bitcoin from exchanges continues to exceed inflow. This development suggests that bullish sentiment prevails, though caution emerges as overall demand may be softening. The ongoing struggle for bulls to push Bitcoin’s price higher could signal an impending correction unless demand strengthens significantly once again. In summary, the interplay between market sentiment, ETF inflows, and short positions appears to shape Bitcoin’s landscape. As the market navigates these dynamics, there remains the potential for volatility triggered by shifts in trader sentiment and position liquidations. Thus, while the current outlook indicates bullish momentum, it also necessitates vigilance as bearish pressures may arise if demand dwindles further.

The landscape of Bitcoin has shown significant fluctuations, with traders actively engaging in both long and short positions based on market sentiment. The recent rise in Bitcoin’s price has generated discussions about the implications of traders’ short positions and the overall funding rates in the derivatives market. Inflows from Bitcoin ETFs serve as a barometer for market confidence and can play a crucial role in price movements. Monitoring exchange flows further adds to the understanding of supply and demand dynamics, shedding light on impending price adjustments.

In conclusion, the interplay of market forces in Bitcoin’s trading environment reveals a precarious balance between bullish optimism and the potential for bearish retracements. The increasing ETF inflows combined with a notable prevalence of short positions could lead to significant price shifts as traders react to these trends. Therefore, it is essential for market participants to remain alert to the evolving conditions that may influence Bitcoin’s trajectory in the near future.

Original Source: ambcrypto.com

Post Comment