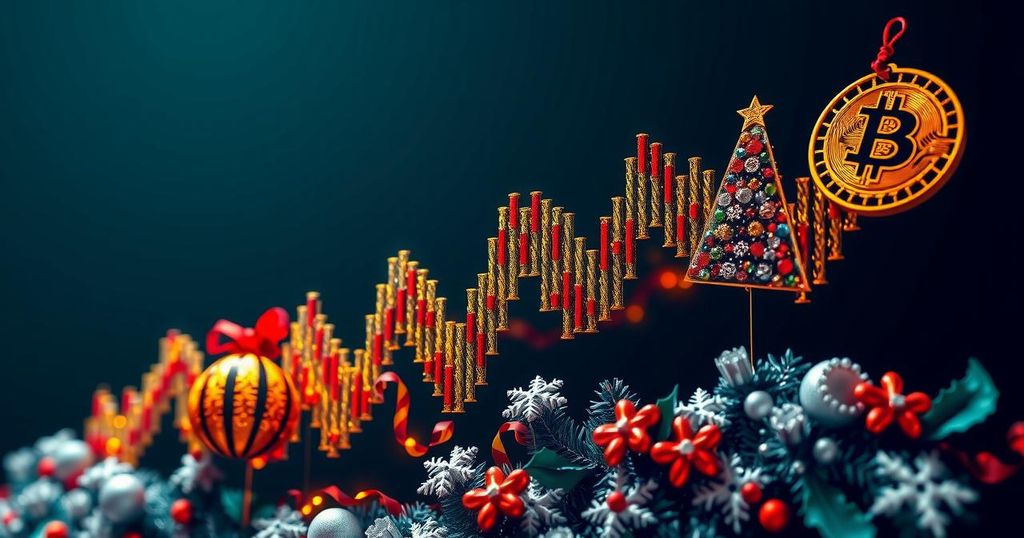

Bitcoin Price Surge Following Trump Victory: Historical Patterns and Future Projections

Following Donald Trump’s presidential victory, Bitcoin has reached a new all-time high, influenced by similar bullish trends noted during Trump’s previous win in 2016. Analyst Mags speculates that Bitcoin could peak around December 2025, with projections varying from $250,000 to potentially as high as $420,000. Recent market data shows Bitcoin’s price reached approximately $93,490, demonstrating strong bullish momentum post-election.

In light of the recent United States Presidential elections, Bitcoin has achieved a remarkable price surge, reaching a new all-time high. This rally is attributed to what analysts term the “Trump effect,” reminiscent of the cryptocurrency’s previous significant rise following Donald Trump’s victory in 2016. Crypto analyst Mags has recently discussed these patterns on social media, noting that during Trump’s first election win, Bitcoin experienced a staggering increase of 2,700% over 400 days. Mags’s analysis suggests that Trump’s recent win could trigger another wave of bullish sentiment in the cryptocurrency market, potentially reinforcing Bitcoin’s established place within mainstream financial discussions. Presently, Bitcoin’s value has already increased markedly post-election, but Mags projects an even more optimistic outlook, indicating that if historical trends recur, Bitcoin might peak in December 2025 or within the fourth quarter of next year. Reviewing previous price movements, Bitcoin traded between $145 to $215 in 2016, then surged to approximately $16,000 following the electoral influence in 2018. Mags anticipates a more moderate increase this cycle, speculating a peak price of around $250,000 with potential upward rally projections as high as $420,000. Some members of the cryptocurrency community have expressed varying perspectives on the feasibility of these projections, with one individual asserting that even achieving half the 2016 growth would result in a tremendous Bitcoin price increase to around $1,215,000. While another community member maintained a more cautious stance, bolstered by realism, suggesting that a $250,000 target remains achievable given current market conditions. Concurrently, the market intelligence platform Santiment confirmed that Bitcoin reached an extraordinary price apex of approximately $93,490 as of the most recent analysis, correlating this increase with noticeable enthusiasm observed across social media channels post-election. Even so, Bitcoin’s price experienced a minor decline to around $89,763 after experiencing a 20% uptick over the previous week. The momentum indicates strong potential for Bitcoin to breach the coveted $100,000 region soon.

The cryptocurrency market has historically been influenced by various external factors, including political events. The term “Trump effect” refers to the phenomenon where Donald Trump’s political actions and victories generate significant impacts on Bitcoin and the broader cryptocurrency market. This has been particularly observable following his election wins, which coincided with major upward price movements in Bitcoin. Analysts use these historical patterns to project future price trends, suggesting that political climate and leadership can affect market sentiment and investment strategies within the cryptocurrency sphere.

In conclusion, the recent surge in Bitcoin’s price following Donald Trump’s victory in the US Presidential elections reflects the significant impact of political events on cryptocurrency valuations. Analyst Mags has indicated potential price peaks for Bitcoin in the coming years, drawing parallels with previous bullish trends. While community perspectives vary, the underlying consensus suggests optimism for Bitcoin’s future as it continues to capture the attention of investors and market enthusiasts alike.

Original Source: bitcoinist.com

Post Comment