Is Bitcoin Nearing a Price Plunge Below $50K? What This Week Could Mean for the Cryptocurrency Market

Bitcoin enthusiasts are accustomed to witnessing the cryptocurrency achieve new high prices, however, the current focus is on the potential for a Bitcoin price drop below $50,000. This week is of particular significance as attention is directed to the U.S. Federal Reserve’s Jackson Hole symposium, which has caused apprehension in the market and raises the possibility of a substantial decrease in Bitcoin’s value.

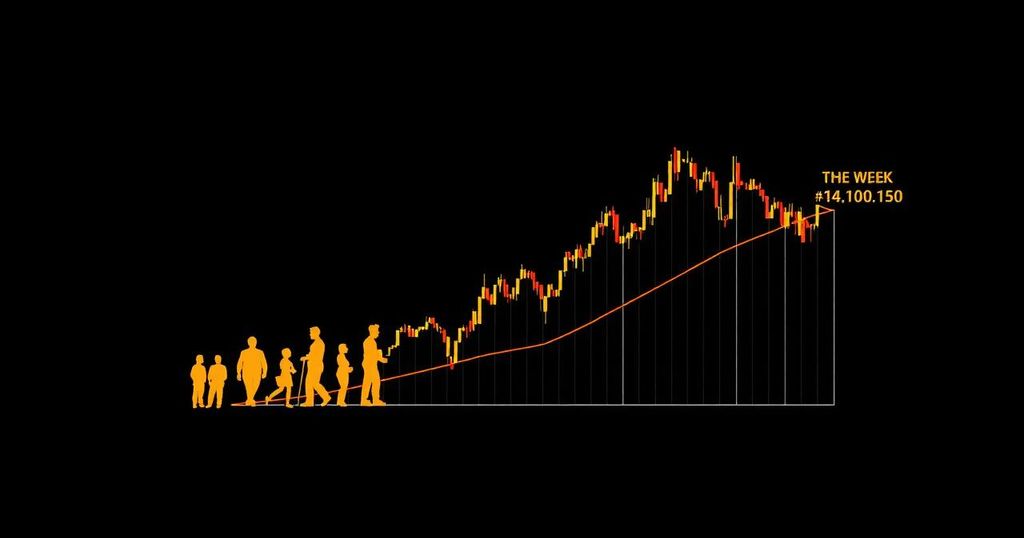

Bitcoin has experienced a period of stagnation, with its price plateauing and causing unease among traders. Despite a promising weekend, Bitcoin’s value ultimately receded, settling at approximately $58,650 by the week’s end. Many traders have closely monitored Bitcoin’s lateral movements and have expressed disappointment. While there is uncertainty surrounding the market’s direction, traders such as Roman have projected a potential decrease in Bitcoin’s value to the $55,000 support level. Although the lack of momentum is evident, the Bollinger Bands point to a possible breakout, though the trajectory remains uncertain.

The focus has now shifted to the U.S. Federal Reserve’s annual Jackson Hole symposium, during which Fed Chair Jerome Powell is slated to address the market. Powell’s announcements have historically had a significant impact on market movements, and amidst discussions of inflation and potential interest rate reductions, traders seek clear signals on the Fed’s future actions. Cryptocurrency markets are particularly sensitive to these macroeconomic factors, and Powell’s statements could incite significant volatility, as foreseen by industry experts.

Despite the bearish outlook and price decreases, Bitcoin miners have remained steadfast. The stability in Bitcoin reserves held in known miner wallets, as reported by CryptoQuant, indicates that miners are not rushing to sell their holdings. However, it is prudent to remain cautious, as miners’ actions have the potential to cause significant market fluctuations.

Bitcoin’s market dominance has also been fluctuating, and some analysts anticipate a decline in Bitcoin’s dominance, which could result in a resurgence in altcoins. This shift in market dynamics is expected to unfold over the next few weeks and signifies a potential end to the bear market for altcoins.

In a separate development, investment banking giant Goldman Sachs recently revised down its U.S. recession probability to 20% from its previous figure of 25%, based on robust retail sales and employment data. While this may appear to be positive news, it carries mixed implications for Bitcoin. A potential rate cut could be welcomed by Bitcoin traders, but it also raises concerns about the impending recession, echoing similar patterns observed in prior rate cuts.

At the time of writing, Bitcoin is valued at $58,541.87, leaving traders and enthusiasts alike eager to see what the upcoming week holds for the leading cryptocurrency.

Post Comment