Bitcoin Approaches $100,000: Key Price Levels and Market Insights

Bitcoin approaches $100,000 as it rises approximately 40% following the recent U.S. election. A breakout from a pennant pattern suggests a bullish move ahead, with a target around $118,000. Key support levels to watch are $93,000 and $70,000 to guide investors during pullbacks.

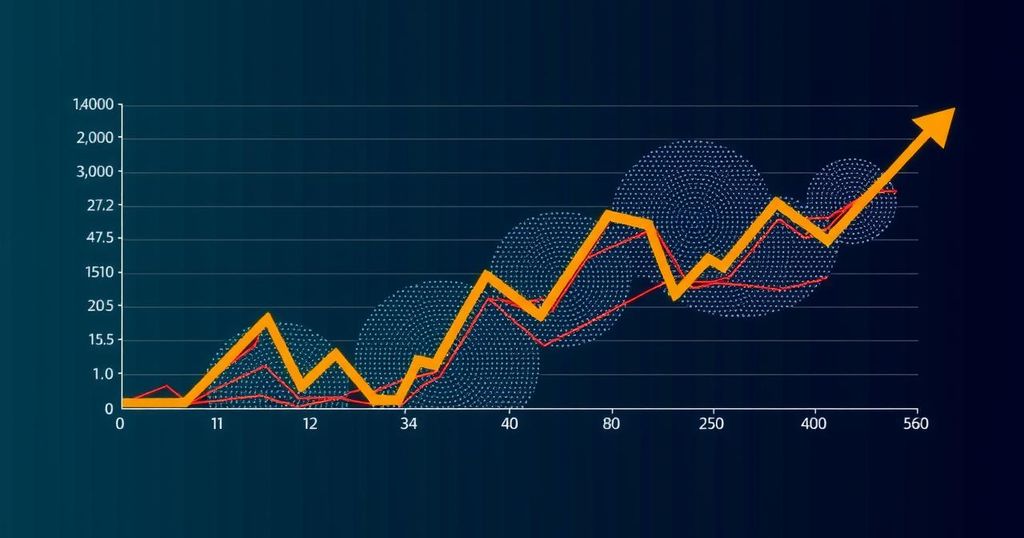

As the new week approaches, Bitcoin remains a focal point as it nears the significant milestone of $100,000, marking its first potential crossing of this level. Following Donald Trump’s election victory on November 5, Bitcoin’s value has risen approximately 40%, fueled by expectations of enhanced regulatory conditions for cryptocurrencies. Recently, Bitcoin broke out from a pennant formation, which suggests a continuation of its bullish trajectory. Technical analysis indicates a projected price target of approximately $118,000 based on historical price trends, while key support levels to monitor include around $93,000 and $70,000.

To begin the week, Bitcoin stands poised to cross the $100,000 threshold, showing impressive momentum. Although the digital asset peaked at about $99,800 last Friday before pulling back slightly to around $98,000 over the weekend, its growth trajectory remains strong. Notably, since Trump’s election win, Bitcoin has experienced a remarkable 130% increase in value year-to-date.

After breaking above an eight-month range, Bitcoin confirmed a bullish trend with a significant golden cross in late October. The emergence from the pennant pattern signals further bullish potential, a sentiment reinforced by heightened trading volumes comparable to those seen in March, suggesting increased institutional interest.

Utilizing a bars pattern for technical analysis allows investors to predict Bitcoin’s potential price movement. By applying this method, analysts identify a bullish price target approaching $118,000—anticipating the price may test this height before entering a potential consolidation phase.

When assessing potential pullbacks, maintaining vigilance around the $93,000 support level is recommended. For investors seeking to capitalize on Bitcoin’s upward momentum, entry opportunities may arise near this level, positioned at the higher end of the pennant structure. Should the price fall further, critical support at approximately $70,000 may attract substantial buying interest, especially as this aligns with previous trading ranges and the upward sloping 200-day moving average.

Overall, as Bitcoin approaches historic price levels, understanding its price patterns and technical indicators will be essential for investors navigating this bullish trend.

The ongoing dynamics surrounding Bitcoin’s pricing are strongly influenced by recent political developments and market trends. Following the election of Donald Trump, there has been rising optimism that a more crypto-friendly regulatory environment may emerge, leading to increased investment in Bitcoin. The significant price movements, including a bullish pennant breakout, further suggest that Bitcoin may continue to gain momentum as institutional investors show interest, thereby affecting the overall cryptocurrency market.

In summary, Bitcoin remains at a critical juncture as it approaches the $100,000 mark for the first time. The recent surge, buoyed by favorable political conditions and heightened institutional interest, points to a potential price target of $118,000. Investors should remain alert to key support levels at $93,000 and $70,000, which will play a crucial role in determining future price movements. As the cryptocurrency market evolves, situational awareness and strategic analysis will inform investment decisions.

Original Source: www.investopedia.com

Post Comment