The Future of Prometheum in a Post-Gensler Cryptocurrency Landscape

Prometheum, a firm that supported the SEC’s crypto rules, faces an uncertain future post-Gensler as pro-crypto Trump ascends to power. Its business model is at risk with an anticipated shift in regulatory perspectives that may redefine cryptocurrencies as securities. Industry skepticism about its market traction further complicates its outlook.

In recent years, the cryptocurrency sector has expressed mounting frustrations regarding the Securities and Exchange Commission’s (SEC) stringent regulatory posture, particularly under Chairman Gary Gensler’s leadership. However, one firm, Prometheum, adopted a different approach by endorsing the SEC’s regulatory framework. This strategy culminated in Prometheum receiving a groundbreaking license for crypto-based securities and subsequently testifying before Congress on digital asset regulations.

The future of Prometheum now appears uncertain as the political landscape shifts with the election of pro-crypto Donald Trump, prompting Gensler to announce his early resignation from the SEC. Previously, Gensler’s administration had categorized nearly all cryptocurrencies, except Bitcoin, as securities. This regulatory stance resulted in several lawsuits that compelled companies to cease trading popular cryptocurrencies like Solana and XRP. Yet, firms such as Coinbase and Robinhood have since reinstated these assets, anticipating a less restrictive regulatory approach from the incoming SEC leadership.

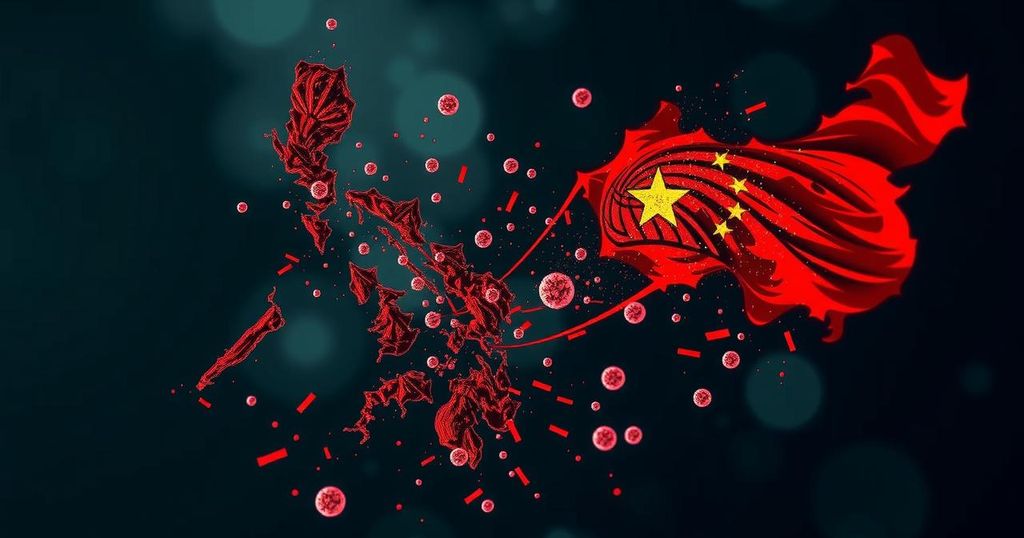

This regulatory evolution poses a significant challenge for Prometheum, whose business model relies heavily on the premise that many crypto tokens qualify as securities. As new regulations loom, Prometheum is under scrutiny both from critics within the crypto community and from a Congress that includes Republican members who have raised concerns regarding the firm’s alleged connections to China—an accusation Prometheum vehemently refutes.

Aaron Kaplan, co-CEO of Prometheum, has articulated the firm’s outlook by suggesting that it has the potential to transcend its crypto foundations and utilize its newly acquired license, known as the Special Purpose Broker Dealer, to engage with a broader array of asset classes. He optimistically noted that, in line with blockchain’s transformative potential, there could be a significant issuance of securities on a blockchain during Trump’s presidency.

Contrastingly, industry experts like Matt Walsh, a co-founder of Castle Island, express skepticism regarding Prometheum’s viability, highlighting the lack of tangible usage of its platform for real-world trading. While financial powerhouses like Goldman Sachs and BlackRock are beginning to explore the realm of tokenized assets, this sector remains largely unproven and niche.

Regarding Prometheum’s client engagement, Kaplan maintained that the firm is in the preliminary stages of development, currently negotiating with various financial institutions aimed at expanding its footprint in the market.

The cryptocurrency industry has long contended with the SEC’s rigid regulations, particularly under the leadership of Gary Gensler. The conflict stems from the SEC’s characterization of numerous cryptocurrencies as securities, leading to significant compliance challenges for crypto firms. In the midst of these regulatory battles, Prometheum positioned itself as an advocate of the existing rules, which resulted in its receipt of a unique license for crypto-based securities. Nevertheless, the political shift marked by Trump’s election and Gensler’s impending exit creates an environment of uncertainty for Prometheum and the crypto landscape overall.

In conclusion, Prometheum’s future hangs in a precarious balance as it navigates a post-Gensler landscape shaped by potential regulatory reforms. While the firm seeks to diversify its offerings beyond cryptocurrencies, significant skepticism remains regarding its market traction. The shifting political dynamics, alongside its associations in Congress, will critically influence its operational viability going forward. Prometheum must now adapt to an evolving regulatory climate and compete effectively in a market that may redefine the security status of many digital assets.

Original Source: fortune.com

Post Comment