Altcoin Season Index Indicates Potential Bitcoin Price Rally Resumption

The Altcoin Season Index rising above 60 suggests impending Bitcoin price gains, with historical data supporting average returns of 10% in one month and projections of BTC reaching $160,000 by mid-2025. Ethereum’s performance also indicates a potential altseason revival, driving further market momentum and gains in altcoins, particularly noted for peaks occurring from February to May.

The recent rise of the Altcoin Season Index above the 60 threshold is a strong indicator of a potential resurgence in Bitcoin (BTC) prices, historically associated with greater gains. Historical data from asset management company VanEck indicates that when this index surpasses 60, Bitcoin tends to experience upward momentum in the following months, with average returns of 10% after one month, 30% after three, and an impressive 73% after six months. This trend supports speculations that Bitcoin could reach a price of $160,000 by mid-2025, despite currently hovering around the $100,000 mark.

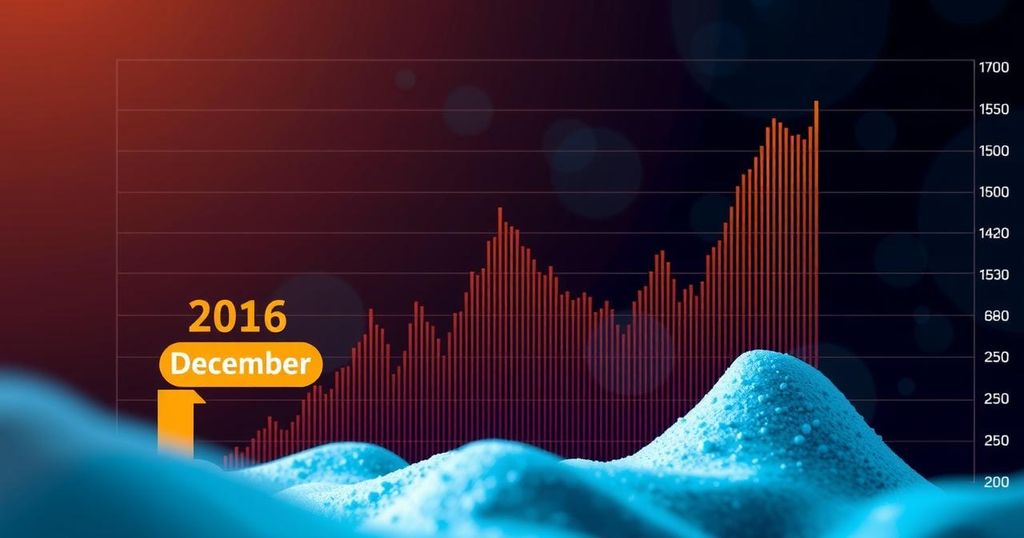

The cyclical patterns within the cryptocurrency market have been emphasized by seasoned trader Michaël van de Poppe, who notes that Bitcoin’s price movement is reminiscent of last December’s growth period. This increase, which raised the global crypto market capitalization from $1.7 trillion to $2.9 trillion, is expected to lead to a renewed phase where altcoins shine, particularly influenced by Ethereum’s recent performance.

Ethereum, having recently broken a critical resistance level, is projected to drive further altcoin market momentum as it approaches previously seen highs of $6,000. The current Altcoin Season Index at a staggering 90 points reflects potential for significant gains, urging traders to consider active positions in altcoins as historical trends indicate that the peak of such seasons often occurs in conjunction with a notable increase in market activity, particularly between February and May.

An analysis suggests that Ethereum’s ability to maintain its recent breakout will be crucial in setting the stage for broader altseason, where altcoins traditionally rally in price in correlation with Bitcoin’s movements. Investors are advised to monitor Ethereum closely as the market approaches potentially lucrative trading opportunities.

The Altcoin Season Index serves as an essential metric that measures the performance of the top 50 cryptocurrencies relative to Bitcoin over a defined period. Historically, a reading above 60 has consistently signaled an impending bullish phase for Bitcoin, wherein substantial gains can be anticipated. In this context, cryptocurrencies such as Ethereum play a pivotal role as their performance often causes widespread effects across the altcoin market. Understanding these dynamics is crucial for traders and investors aiming to capitalize on market trends within the cryptocurrency space.

The analysis of the Altcoin Season Index and past performance trends indicates a promising trajectory for Bitcoin prices, potentially culminating in significant returns over the upcoming months. The vital role of Ethereum, with its recent breakout and positive momentum, further supports the likelihood of an impending altcoin rally. As the market figures suggest, traders should remain vigilant during this period, particularly between February and May, when historical gains have been most pronounced.

Original Source: www.crypto-news-flash.com

Post Comment