Bitcoin’s Decline Persists: Analyzing Market Trends and Support Levels

Bitcoin continues to decline, trading under $100,000 and approaching support near $92,000. Critical resistance is seen at $98,500, while key supports are at $95,500 and $93,200. Technical indicators show bearish momentum, suggesting potential for further losses without a recovery above the resistance levels.

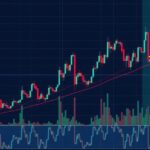

Bitcoin has continued its downward trend, trading below the $100,000 mark, and appears poised to slide further towards the $92,000 support level. The cryptocurrency began its recent decline from the $102,000 resistance area and is facing significant challenges in regaining that value. Currently, it is trading beneath the 100-hour Simple Moving Average and has formed a key bearish trend line with resistance at approximately $98,500 on the hourly chart of the BTC/USD pair. If Bitcoin manages to stay above the $95,500 support zone, there may be potential for a price recovery.

Despite these challenges, Bitcoin price experienced a setback, losing momentum below both the $100,000 and $98,000 levels. It reached a low of $95,586, where it is now attempting to consolidate its losses. Resistance is positioned close to the $98,500 level, also serving as the 23.6% Fibonacci retracement level for the recent downward movement. If Bitcoin climbs above the $100,000 threshold, the price could test subsequent resistance at $102,000, with even higher gains possible toward $103,400 or $105,000.

However, should Bitcoin fail to breach the $98,500 resistance, further declines are likely, with immediate support at $96,200 and major support near $95,500 and $93,200. Continued losses could lead Bitcoin to test the $92,000 support in the near future. Technical indicators reveal a bearish trend as the hourly MACD shows increasing bearish momentum and the RSI is below the neutral threshold of 50.

The current landscape of Bitcoin trading exhibits a significant decline as it descends below the key psychological level of $100,000. The price has been under pressure since peaking at $102,000 and is witnessing a shift toward major support levels that may define its immediate future. Understanding the roles of the support and resistance levels, Fibonacci retracement levels, and technical indicators is integral when analyzing Bitcoin’s trajectory in the volatile cryptocurrency market.

In summary, Bitcoin’s ongoing decline is marked by trading below critical resistance levels and approaching significant support zones. The failure to recover above $98,500 could prompt further bearish movements toward the $92,000 mark. Conversely, a successful breach above $100,000 could signal potential upward momentum. Consequently, market participants should remain vigilant and conduct thorough analyses leading to informed decision-making concerning their investments.

Original Source: www.newsbtc.com

Post Comment