Bitcoin Price Analysis: Is a Recovery to $100K Possible After Recent Decline?

Bitcoin has faced an 8% drop, testing strong support at $90,000 post a consolidation near $108,000. With potential for a rebound, attention shifts to the $90,000 mark as critical. The SOPR metric reflects growing investor confidence amid cautious economic outlooks.

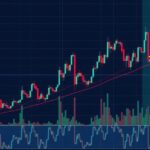

In recent market activity, Bitcoin has been exhibiting an ascending consolidation near the pivotal resistance level of $108,000, although it has encountered a notable downturn. This decline witnessed Bitcoin experiencing a 15% drop, stabilizing around the support level of $90,000, which also aligns with the mid-line of a longstanding upward price channel. Despite this setback, there exists a possibility for a short-term bullish rebound. If Bitcoin manages to rebound from this critical support, it may initiate another attempt to breach the $108,000 resistance. However, should it fail to maintain this support, the cryptocurrency could experience a more pronounced correction, with the lower boundary of the price channel, situated around $75,000, serving as the next significant support level.

On examining the 4-hour chart, Bitcoin has maintained a consistent uptrend within a broad bullish channel. The recent rejection at the $108,000 mark catalyzed a decline to $95,000, which serves as a vital support level. A bounce from this region is anticipated, allowing for stabilization and a potential resumption of the upward trend. Nevertheless, future movements may be influenced by broader monetary policy considerations, which could exacerbate selling pressure and lead to a bearish break. In such circumstances, Bitcoin’s immediate target may revert to the $90,000 mark, with long-term support at $75,000.

The Bitcoin Long-Term Holder SOPR metric further elucidates market dynamics and investor sentiment. Following a prolonged period below 1, indicating losses among holders during market downturns, the SOPR began trending upwards by mid-2023, signaling renewed investor confidence aligned with Bitcoin’s price recovery. Throughout this ascendant phase, the SOPR has consistently remained above 1, suggesting that long-term holders have begun realizing profits without substantial selling pressure, reinforcing a positive market outlook and potential for further expansion.

Bitcoin has been the subject of extensive analysis, particularly during its fluctuating phases of price consolidation. Analyzing both the daily and hourly charts reveals intricate patterns and support levels that traders utilize when strategizing their next moves. The relationship between market sentiment, as indicated by the SOPR metric, and price trends showcases the psychology of investors in response to market conditions. Understanding these indicators is crucial for predicting future price movements in the volatile cryptocurrency market.

In conclusion, Bitcoin’s recent fluctuations highlight both opportunities and challenges within the current market landscape. The strong support levels at $90,000 and beyond are critical in determining whether a short-term bullish reversal can indeed take place. The trend in the SOPR metric suggests a shift towards positive market sentiment among long-term holders, which may provide a foundation for future growth. Close attention to broader economic factors and investor behavior will be essential in navigating the forthcoming market dynamics.

Original Source: cryptopotato.com

Post Comment