Bitcoin Price Dips Below Key Levels: Is a Major Drop Imminent?

Bitcoin has fallen below $95,000, showing signs of bearish momentum. Recent dips have placed it around $92,417, with potential to decline further if it cannot surpass key resistance levels around $95,000 and $96,000. Investors should watch for major support at $92,000 and $91,200, as continued losses may bring Bitcoin closer to $90,000.

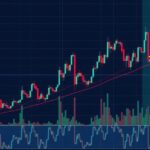

The price of Bitcoin has recently dipped below the $95,000 threshold, exhibiting significant bearish trends that suggest a potential for further decline. Currently trading under $94,000, Bitcoin has dropped under the vital 100 hourly Simple Moving Average, signaling the possibility of falling below the $92,000 support level. A notable bearish trend line has formed with resistance at $95,000, which must be exceeded for any chance of recovery.

Following a downward trajectory, Bitcoin’s price failed to advance past the $98,000 zone and continued to decline past both the $96,500 and $95,500 levels. A recent low point was reached at $92,417, though there was a minor recovery above the $94,000 mark, which slightly revised the downtrend. The BTC/USD trading pair must maintain above $92,000 to prevent further declines, while immediate resistance is identified at the $95,000 level, with significant resistance around $96,000, which, if breached, could facilitate upward movement toward $97,500.

Conversely, if Bitcoin cannot rebound above the $95,000 resistance, it is likely to witness continued bearish movement. The immediate support level rests at approximately $92,400, with critical support around $92,000 and subsequent support at $91,200. In the case of persistent losses, the price may approach $90,000. Technical indicators show that the hourly MACD is moving deeper into bearish territory, and the Relative Strength Index is below the neutral 50 level, indicating weak bullish sentiment.

Recent trends in Bitcoin price movements suggest heightened volatility leading to potential declines, particularly as it fell below $95,000. Bitcoin has historically faced resistance and support levels that guide investor behavior. Investors must diligently watch for critical points at which the price either rebounds or falls further. The cryptocurrency market is susceptible to rapid changes influenced by trader sentiment and market dynamics. A deeper understanding of technical indicators, such as moving averages, MACD, and RSI can aid investors in making informed decisions regarding Bitcoin and its price fluctuations.

In summary, Bitcoin’s recent performance indicates a notable downturn below the $95,000 mark, with critical support levels at $92,000 and $91,200. The challenges it faces to breach resistance at $95,000 and $96,000 may dictate its short-term trajectory. Investors monitoring these key levels should exercise caution and utilize careful analysis before making further financial commitments in the cryptocurrency market. Understanding technical indicators remains paramount in navigating potential future movements in Bitcoin’s price.

Original Source: www.newsbtc.com

Post Comment