Bitcoin Faces Uncertainty: Analyzing Current Price Trends and Resistance Levels

Bitcoin price is consolidating below $95,500, with bearish trends apparent. Recovery attempts are struggling against resistance at $95,800, while support is located at $92,500. Without breaking resistance levels, a potential decline toward $90,000 could occur.

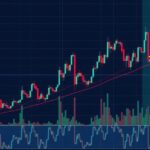

Bitcoin is currently experiencing a period of consolidation, with prices remaining below the crucial $95,500 mark. Recent movements indicate bearish trends, and recovery efforts are struggling against the $95,800 resistance threshold. Initially, BTC exhibited potential by rising from the $91,150 level and briefly surpassing both the $93,500 and $94,000 marks, aided by a breach of a bearish trend line on the hourly chart. Nonetheless, ongoing bearish sentiment persists as Bitcoin trades below $94,500 and the 100-hour simple moving average. Immediate resistance is observed near $95,000, with a pivotal hurdle at $95,800, which, if surpassed, could catalyze further price increases toward levels of $97,000 and beyond. Conversely, without a rise above these levels, Bitcoin risks a decline, with notable support located at $92,500, followed by $92,000 and $91,200, potentially leading toward the psychological $90,000 mark.

The backdrop of Bitcoin’s current performance is characterized by significant volatility and price fluctuations, common features of cryptocurrencies. Investors closely monitor technical levels to predict potential price movements. The analysis indicates that Bitcoin commenced a recovery attempt from lower levels but faces robust resistance that could hinder upward momentum. Understanding these dynamics is crucial for stakeholders in assessing market risks and opportunities.

In summary, Bitcoin’s price is at a critical juncture, oscillating below the $95,500 resistance level while exhibiting bearish trends. To gain upward momentum, BTC must breach the $95,800 resistance; otherwise, it may succumb to declines toward key support levels. Continuous monitoring of market dynamics, alongside technical analysis, is essential for informed decision-making in cryptocurrency investments.

Original Source: www.newsbtc.com

Post Comment