Recent Trends in DeFi Interest Rates: Leading Options for Lending and Savings

**Recent Trends in DeFi Interest Rates: Leading Options for Lending and Savings**

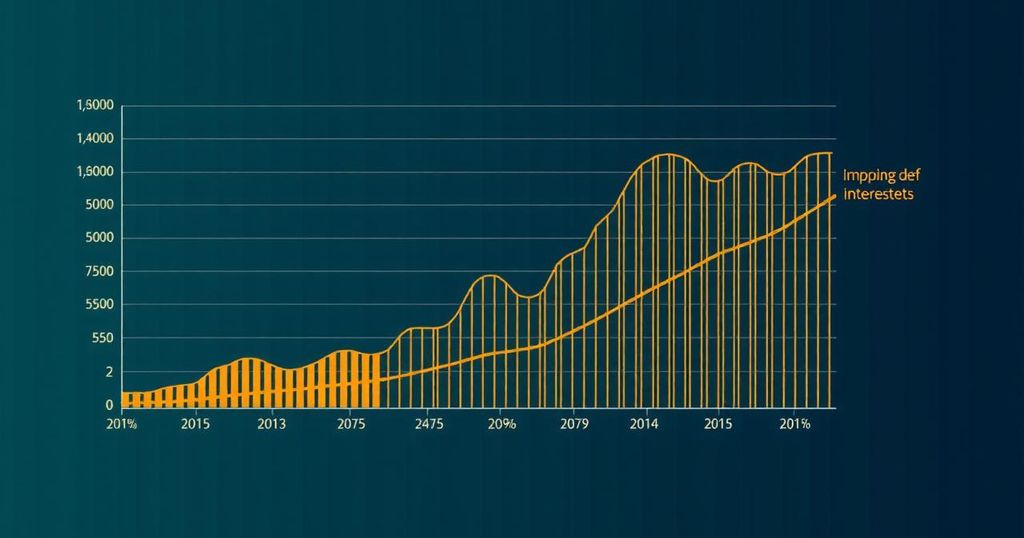

In the rapidly evolving landscape of Decentralized Finance (DeFi), investors continuously seek platforms offering favorable interest rates for lending and saving various digital assets. This week’s highlights include competitive yields for notable cryptocurrencies such as USDC, USDT, DAI, ETH, and WBTC across premier lending protocols. The highest current yields are as follows:

– Aave: USDC at 3.88%, USDT at 3.90%, DAI at 3.81%, ETH at 1.85%, WBTC at 0.14%.

– Coinbase: USDC at 5.20%, ETH at 2.17%.

– Vesper: USDC at 6.33%, DAI at 0.10%, ETH at 4.44%, WBTC at 0.03%.

These rates reflect the intense competition among DeFi platforms, each offering distinct advantages to investors.

In terms of market presence, Aave and Compound lead the way among DeFi platforms.

Aave stands as a well-established decentralized lending protocol that allows users to borrow and lend cryptocurrencies via Ethereum blockchain-based smart contracts, covering 25 markets.

Conversely, Compound is recognized for its longevity and dominance, providing borrowing and lending for twelve digital assets and facilitating a variable yield on deposited funds.

Coinbase, while having a limited DeFi offering, earns trust through its extensive customer base and regulatory compliance as a publicly traded U.S. company.

Other notable platforms include dYdX, which specializes in decentralized derivatives trading, and Vesper, a platform dedicated to maximizing yield by deploying pooled assets through various DeFi protocols.

Additional emerging platforms such as BENQI, C.R.E.A.M., Yearn.finance, Spark Protocol, and Morpho each play a pivotal role in enhancing DeFi’s flexibility and user interaction, catering to diverse lending and borrowing needs through innovative protocols.

Defining DeFi, it characterizes open-source, blockchain-powered financial applications aimed at democratizing access to financial products and services globally. Users may deposit assets to earn yield, borrow assets, engage in liquidity provision for trading pools, and explore investment opportunities in tokenized traditional assets among other functionalities.

The appeal of DeFi lending primarily lies in its ability to offer significantly higher interest rates compared to conventional banks. The elevated rates stem from the robust demand from institutional and professional investors seeking to leverage crypto positions, thereby creating lucrative opportunities in the crypto market.

However, it is crucial for investors to recognize the inherent risks associated with DeFi lending, including smart contract vulnerabilities, market volatility, potential oracle failures, and liquidity risks. Moreover, the possibility of stablecoins de-pegging raises concerns for deposited assets, underscoring the need for caution.

As a conclusion, while DeFi loans provide a streamlined approval process and attractive interest rates, they come with heightened risks compared to traditional lending solutions. Investors are advised to conduct thorough assessments of the platforms they choose to engage with, balancing potential yields with associated risks. It is prudent to diversify investments and only allocate capital one can afford to lose.

To remain informed about the latest developments in the digital asset markets, I recommend subscribing to authoritative platforms like Bitcoin Market Journal, which provide valuable insights into this dynamic sector.

Post Comment