Bitcoin Price Decline to $91,000 Suggests Temporary Setback Amid Recovery Hints

Bitcoin’s price recently fell to $91,000, indicating a rounding top pattern and triggering panic selling. Despite significant deposits on exchanges, long-term holders show confidence in a potential recovery. A rebound is possible if Bitcoin surpasses critical resistance levels, potentially leading to a rise toward $100,000 and restoring investor confidence.

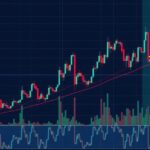

Bitcoin has recently experienced significant volatility, marked by a 6.4% decrease in value that culminated in an intra-day low of $91,000. This price drop appears to indicate a rounding top pattern, eliciting a wave of panic selling among investors. Notably, despite this downturn, one particular group of investors signals a potential quick recovery from this dip.

In the wake of this price decline, Bitcoin deposits onto exchanges spiked dramatically, exceeding 80,000 BTC, which is approximately $7.5 billion. Such a movement is generally interpreted as a precursor to selling, as traders seek liquidity in challenging market conditions. Nevertheless, this surge in deposits may stem from panic rather than a fundamental shift in investor sentiment, as such actions do not always denote a lasting bearish trend.

The Coin Days Destroyed (CDD) metric, which monitors the activity of long-term holders, offers valuable insights into market trends. Spikes in CDD typically coincide with sell-offs. Intriguingly, even with the drop to $91,000, long-term holders displayed remarkable resilience, remaining largely inactive. This suggests confidence among these investors regarding a potential recovery, indicating that the current market fluctuations might be temporary.

Although Bitcoin’s formation of a rounding top pattern raises concerns, it is plausible that it may evolve into an inverse cup and handle pattern. The existing bearish momentum lacks intensity, presenting Bitcoin an opportunity to rebound from the $93,625 support level. Should Bitcoin successfully recover, it could rally toward the $100,000 mark, contingent on surpassing the $95,668 threshold.

A successful breach and conversion of the $100,000 resistance into support would negate the bearish sentiment and could lead to an ascent towards $105,000, reflecting a significant recovery from recent losses. Such a rebound would likely restore investor confidence and stabilize the market after the recent volatility.

Bitcoin, the leading cryptocurrency, often experiences significant price fluctuations influenced by market patterns, investor sentiment, and trading volume. The rounding top pattern, characterized by peaks in price followed by a decline, can indicate potential downturns. The behavior of long-term holders is critical in informing market outlooks, as their decisions often reflect broader market trends. Understanding these dynamics is essential for predicting Bitcoin’s price movements during periods of uncertainty.

In summary, Bitcoin’s recent price drop to $91,000 has spurred panic among some investors, leading to increased deposits on exchanges. However, the inactivity of long-term holders indicates potential resilience and an expectation of recovery. Despite the formation of a bearish pattern, prospects for a rebound are present, contingent on overcoming key resistance levels, which may bolster market confidence moving forward.

Original Source: beincrypto.com

Post Comment