Bitcoin Price Decline: Critical Support and Resistance Points to Monitor

Bitcoin has declined below $95,000, currently priced around $91,500. Immediate resistance is at $92,200, with support levels at $91,500 and $90,000. Technical indicators reveal bearish momentum, emphasizing investor caution amid recent market trends.

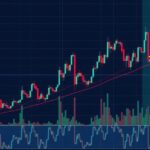

Bitcoin has experienced a significant decline, falling below the $95,000 support level, which has raised concerns among investors. The cryptocurrency has seen a fresh downturn beginning from the $98,500 mark, and it is currently trading below both $95,500 and the 100-hour Simple Moving Average (SMA). A notable short-term triangle has formed with resistance identified at approximately $92,200 on the hourly BTC/USD chart from Kraken.

The price has continued its downward trend, unable to maintain stability above the $96,500 threshold. Bitcoin’s value has significantly declined, plunging below the critical support levels of $95,000 and $94,200, with further dips taking it below $92,500 and testing the $90,800 area. A low was recorded at $90,888, with the current price hovering around $91,500, facing immediate challenges near the 23.6% Fibonacci retracement level regarding the previous downward movement.

At present, Bitcoin’s trading position is below $94,200 and the 100-hour SMA. Immediate resistance is located near the $92,200 mark, coinciding with the short-term triangle pattern. The initial key resistance level is around $93,200, followed by the potential for a further upward movement towards the $93,650 or the 50% Fibonacci retracement level, which might catalyze additional gains pushing the price higher.

Conversely, if Bitcoin fails to surpass the $92,200 resistance level, it may initiate a new decline. Current immediate support is around $91,500, with a significant support threshold at $90,850 and the pivotal $90,000 level. Continued losses may lead to a decline towards the $88,500 support area, with the primary support resting at $86,400.

Technical indicators reveal that the Hourly MACD is accelerating in a bearish direction, while the Relative Strength Index (RSI) is positioned below the 50 level. These metrics suggest a continued weakening in price momentum, urging vigilance among investors amid current trading fluctuations.

In summary, Bitcoin’s price has experienced a notable decline, prompting a focus on key support and resistance levels. To counteract further losses, Bitcoin must consolidate above the significant $90,000 mark while facing substantial resistance at the $92,200 level. Technical indicators suggest a bearish sentiment in the market, underscoring the need for awareness among stakeholders regarding potential price movements.

Original Source: www.tradingview.com

Post Comment