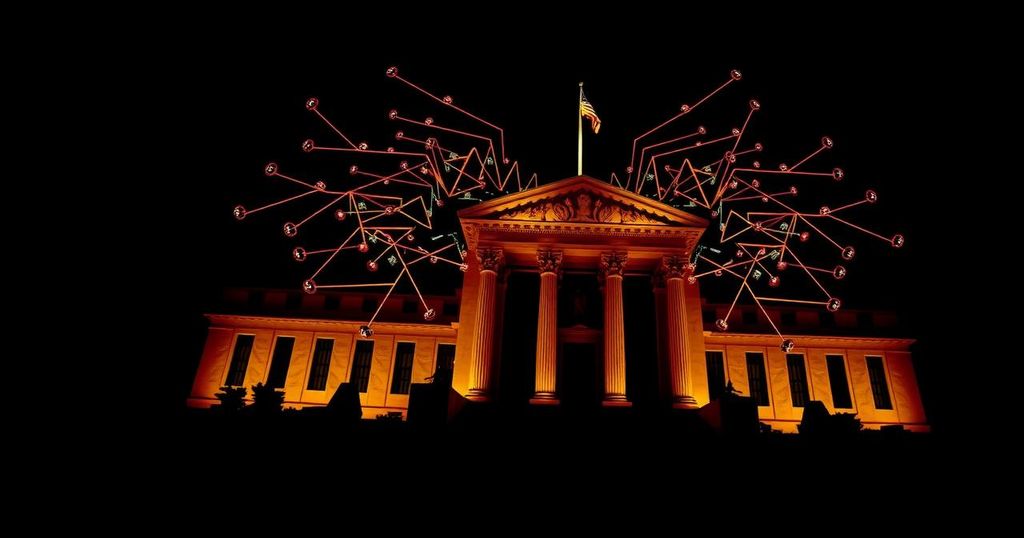

Surge in Bitcoin Demand Following Fed Chair Powell’s Address at Jackson Hole

Following Federal Reserve Chairman Jerome Powell’s address at the Jackson Hole symposium, the price of Bitcoin experienced a notable increase this past weekend. Recent on-chain analyses indicate that the announcement regarding potential interest rate reductions has catalyzed a significant surge in Bitcoin demand over the last twenty-four hours.

As reported by Julio Moreno, Head of Research at CryptoQuant, there has been a marked rise in Bitcoin demand within the United States subsequent to the Federal Reserve’s indication that a cycle of interest rate reductions is imminent. Such lower rates generally benefit volatile assets, such as Bitcoin, the preeminent cryptocurrency. Typically, falling interest rates result in decreased returns from traditional financial instruments like bonds, thereby rendering cryptocurrencies more appealing to investors seeking higher yields.

Moreno further noted that the Bitcoin price premium on Coinbase, the largest cryptocurrency exchange in the United States, has escalated to its highest level since mid-July. The Coinbase premium reflects the discrepancy between Bitcoin’s price on Coinbase and its value on other global centralized exchanges. An increase in this premium often signals a growing demand among U.S. investors, who appear willing to pay a premium to acquire Bitcoin. This elevated demand aligns with the anticipated interest rate cuts and the decreased profitability of traditional financial products.

Rising demand represents a positive outlook for Bitcoin’s pricing, suggesting that investors are strategically positioning themselves to capitalize on potential future gains in the cryptocurrency market. However, this uptick in demand, alongside the rising price premium, could also lead to heightened market volatility.

This increase in demand for Bitcoin coincides with a period during which demand had stagnated for several weeks. According to a report from CryptoQuant, the evident demand for Bitcoin has been lackluster since April 2024 when its price hovered around $70,000. The firm emphasized that for Bitcoin’s price to gain upward momentum, a consistent improvement in demand is essential. If the recent growth in demand within the United States can be sustained and replicated in other markets, investors may witness Bitcoin approaching its historical peak.

As of the current moment, Bitcoin’s price stands at approximately $64,000, reflecting a more than 5% increase within the past day. CoinGecko data reveals that the cryptocurrency has appreciated by 7.5% over the course of the past week. Such developments warrant close observation as the market continues to evolve amid shifting macroeconomic factors.

Post Comment