Bitcoin and Solana Price Predictions: BTC Eyes $70K Amid Significant Inflows

The recent developments in the cryptocurrency market indicate a potential bullish trend for Bitcoin (BTC) and Solana (SOL), highlighted by significant fund inflows and price movements.

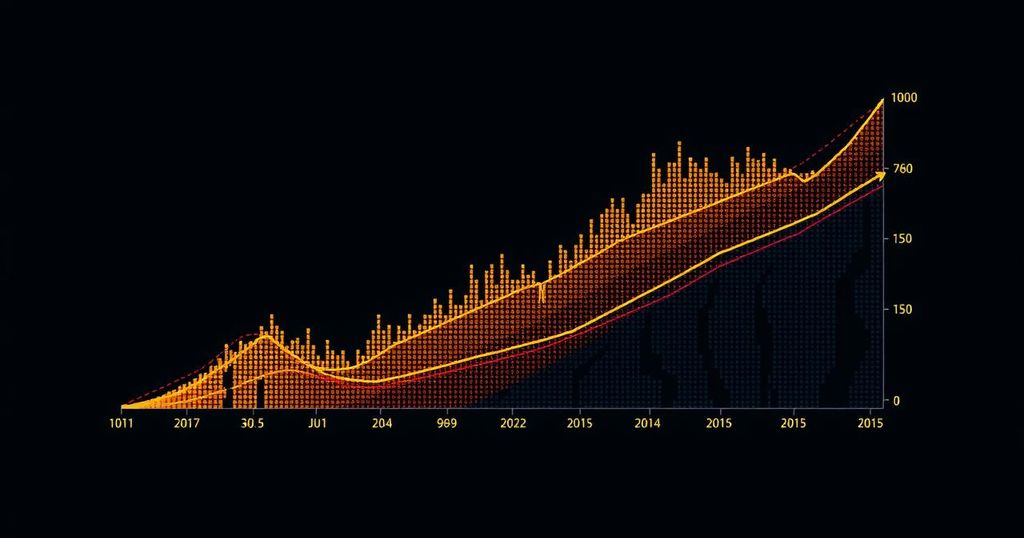

Bitcoin has resumed its upward trajectory, now trading above a crucial short-term support level at $20-day EMA, as bulls set their sights on reaching the $70,000 milestone. Recent reports from CoinShares reveal that digital asset investment products have experienced inflows totaling $533 million, with Bitcoin alone accounting for $543 million of this figure. This surge in investor confidence is reflected in the performance of Bitcoin exchange-traded funds (ETFs), which attracted $252 million in net inflows last Friday. Such positive sentiment follows the uplifting speech delivered by Federal Reserve Chair Jerome Powell at the Jackson Hole meeting, which has altered market expectations regarding interest rates.

On the technical front, Bitcoin’s price has fluctuated around $63,722, maintaining support above the 20-day EMA at $63,386. For traders, the ability to recapture the threshold of $64,000 will markedly bolster the case for long positions in anticipation of a climb towards $70,000. Conversely, a downturn below the 20-day EMA could trigger a sell-off and potential descent to levels around $62,000 or lower, should market sentiment deteriorate.

Meanwhile, Solana has also displayed positive momentum, swiftly rebounding from a low of $140 to surpass the $160 mark. The price action has led to liquidations of approximately $2.24 million in short positions, as traders adjust their strategies. The current support level at $160 is critical for Solana, as it aims to push toward $164 to complete a breakout of the falling wedge pattern. Encouragingly, an upcoming crossover of the 50-day and 200-day EMAs suggests that traders may turn increasingly bullish, positioning themselves for potential upward momentum.

In summary, both Bitcoin and Solana are currently positioned to take advantage of favorable market dynamics, underscored by significant fund inflows and supportive technical indicators. Should the bulls maintain control, BTC may very well approach $70,000 in the near term, while SOL seeks to consolidate its gains above the $160 threshold.

As market participants weigh these developments, insightful discussions and analyses will be necessary to navigate this evolving landscape effectively. Investors are encouraged to monitor key support and resistance levels closely in the days ahead, ensuring they remain informed and strategic in their trading decisions.

Post Comment