Bitcoin Price Update: Elliott Wave Analysis and Trading Strategy

Bitcoin’s Elliott Wave analysis signals a potential new uptrend in Wave V, following a corrective move from Wave III. Traders are encouraged to watch support levels and implement long strategies, with specific attention to risk management as indicated by cancellation levels. Comprehensive market understanding is essential due to the inherent risks involved in cryptocurrency trading.

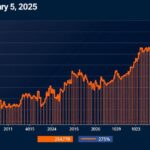

The current analysis of Bitcoin (BTC) through Elliott Wave technical analysis suggests a pivotal moment for traders. Having completed a corrective move from the peak of Wave III, there are indications of a potential Wave IV reversal, setting the stage for an emerging Wave V, which may provide valuable trading opportunities.

As Bitcoin prepares for Wave V, an upward trend seems imminent. Wave IV has experienced a correction characterized by a flat structure consisting of the segments (A)-(B)-(C). The critical reversal point for this structure is identified at $78,402.68, which will be crucial for traders to monitor as they anticipate new market highs and target Fibonacci levels, notably set at 161.8% reaching $126,549.66.

Traders are advised to employ a long strategy by buying when Bitcoin’s price reaches significant support levels. Particularly, should BTC/USD maintain its rate above $90,897.00 and trend upward, this presents a promising buying opportunity for those looking to capitalize on the Wave V trend. Risk management is essential; thus, the cancellation level for this bullish structure is pegged at $78,402.68, beyond which the potential for a continuation of the uptrend may be compromised.

The information provided through TradingLounge constitutes general analysis and recommendations. It is important for investors to acknowledge the inherent risks associated with trading cryptocurrencies, as historical results do not guarantee future performance. Prospective traders should consider their financial circumstances and possibly consult with financial advisors before engaging in such activities.

In summary, the Elliott Wave analysis indicates that Bitcoin is entering a crucial period as it prepares for a new uptrend with Wave V. The established reversal point and strategic levels for investment are pivotal for traders looking to navigate the volatile cryptocurrency market effectively. Risk management remains a critical factor in protecting against potential losses. It is advisable for traders to perform their due diligence and consider personal financial situations before proceeding with market engagements.

Original Source: www.fxstreet.com

Post Comment