Bitcoin Price Analysis: Bearish Sentiment Prevails Amid Market Uncertainty

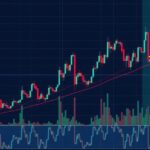

Bitcoin is currently trading at approximately $86,668 with a market value of $1.71 trillion. The technical patterns indicate a bearish trend, with potential support seen at $82,000. A significant resistance level exists at $90,000. Short-term forecasts lean toward caution as the market may test lower support levels. Long-term prospects could improve if buying interest increases above $91,000.

Bitcoin is currently priced at approximately $86,668, reflecting a market valuation of $1.71 trillion and daily transaction activity of around $69.5 billion. Its trading range has fluctuated between $84,971 and $90,940, with technical patterns indicating a cautious outlook for the near future.

The daily chart indicates ongoing liquidation pressures following a rapid decline from a peak of $106,000. While a temporary stabilization has occurred around $78,197, recovery efforts are impeded by significant resistance at $94,000. The prevailing bearish formations, exacerbated by strong selling activity, suggest that $82,000 could serve as a critical support level should the decline continue.

In the shorter term, metrics such as the exponential moving average (EMA 10) at $88,933 and the simple moving average (SMA 10) at $87,407 indicate vulnerability, contrasting with the stronger EMA 200 at $85,831 and SMA 200 at $83,037, which suggest underlying demand.

Analyzing the four-hour timeframe, Bitcoin experienced a sharp drop from $95,152, revealing weak performance above $90,000. Increased selling activity has reinforced this downward trend, with both the EMA 10 and SMA 10 positioned below current market values, reflecting negative sentiment.

A failed attempt to rally past $91,000 confirms this level as a significant resistance zone, making it prudent to adopt short-term bearish strategies, particularly if prices remain in the range of $88,000 to $90,000, with targets set at $85,000 or $82,000.

The hourly analysis underscores immediate liquidation trends, as repeated setbacks near $91,560 have pulled prices down to $84,713. Diminished trading volume suggests a lack of conviction, with prevailing momentum leaning toward further downward movement.

Relative strength index (RSI) readings at 42 lend neutrality, but indicators such as the awesome oscillator (AO) and momentum gauges show signs of distribution. A failure to breach $88,500 may trigger additional retreats toward $86,000 or lower. Conversely, a vigorous surge past $87,000, supported by increased participation, could lead to temporary rallies toward $89,000 or $90,000.

Momentum metrics collectively advocate caution, with the commodity channel index (CCI) resting at -55 and the AO reflecting bearish perspectives. A consistent sell signal is issued across various trend-tracking tools, with only the distant SMA 200 at $83,000 indicating potential support strength.

Bitcoin currently faces downward risks while remaining tethered to resistance. Key support levels at $85,000, $82,000, and $78,000 may undergo testing prior to any return to equilibrium. Unless there is a clear breakthrough above $91,000, the most likely trend appears to be downward, suggesting potential challenges at deeper support levels in subsequent trading sessions.

Bull Verdict: While short-term bearish tendencies are evident, long-term support near $83,000 and $85,000 could present a strong base for recovery, contingent on buyer engagement. A breakout past $91,000 may indicate a return to upward momentum.

Bear Verdict: Bitcoin is entrenched in a downtrend, facing robust resistance at $90,000, with various indicators suggesting further decline. If selling pressure continues, a test of lower support levels around $82,000 and $78,000 may occur before any substantial rebound.

In summary, Bitcoin is confronting significant downward pressure, with the immediate outlook leaning pessimistic due to strong resistances and bearish indicators. Key support levels at $85,000, $82,000, and $78,000 warrant close monitoring. The potential for recovery hinges on the ability to break through key resistances, especially the $91,000 mark, which could signal a shift toward a more bullish sentiment.

Original Source: news.bitcoin.com

Post Comment