Bitcoin Stabilizes Amid Market Uncertainty: Predictions from Experts

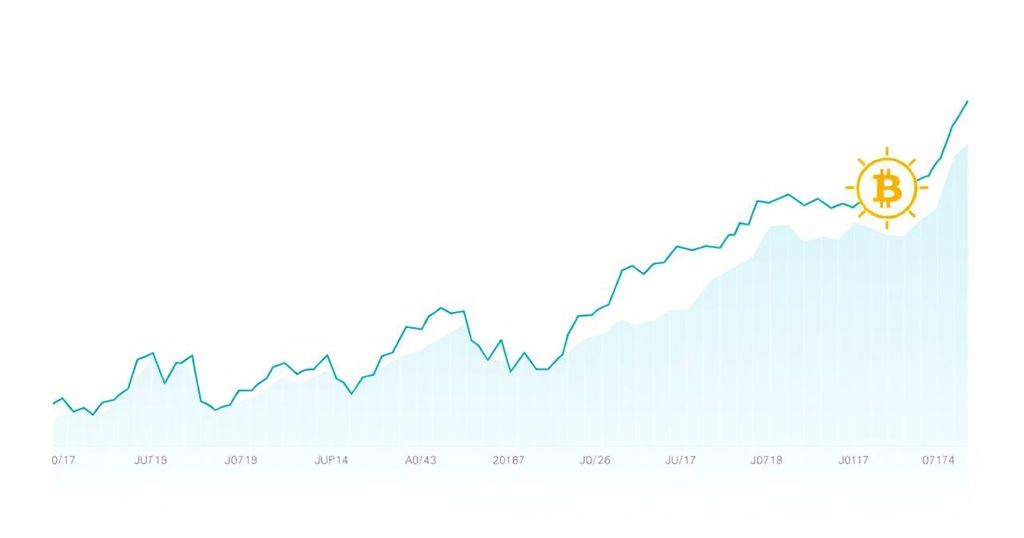

Bitcoin’s recent stabilization at $81,000 comes after a substantial decline since President Trump’s inauguration. Analysts predict ongoing volatility due to macroeconomic influences, with forecasts suggesting a potential drop below $70,000. Experts stress the importance of patience and strategic investment in navigating the current market conditions, while maintaining a cautious optimism regarding the long-term prospects for Bitcoin.

The cryptocurrency market has experienced a significant downturn, losing a quarter of its value since President Donald Trump’s inauguration. Currently, Bitcoin has stabilized around $81,000 after a recent 2.6% decline, yet analysts warn of potential volatility due to Trump’s trade policies and recession concerns. Despite efforts to alleviate regulatory pressures and establish a Bitcoin strategic reserve, the outlook remains cautious.

Mena Theodorou, co-founder of Coinstash, notes that Bitcoin is aligning closely with traditional markets, indicating its susceptibility to macroeconomic factors rather than functioning solely as a hedge. Theodorou suggests that Bitcoin could potentially drop below $70,000, approaching its significant support level around $69,000, previously an all-time high.

Analysts Chris Mills and David Brickell express concerns regarding Bitcoin’s volatility correlated with the stock market’s performance. They emphasize that as equities decline, particularly tech stocks, Bitcoin’s value is likely to follow suit due to its classification as a “risk-on” asset. They also mention that uncertainty surrounding tariffs adds to the negative investor sentiment, although the establishment of a Bitcoin reserve is a positive step for the asset class.

Mark Hiriart from Zerocap highlights that a Federal Reserve interest rate cut may benefit assets like Bitcoin, but ongoing trade tensions and economic instability cast uncertainty. He remarks, “Sticky inflation and tariff threats are fueling a flight to safety,” while noting that Bitcoin has historically presented buying opportunities during dips. Hiriart maintains belief in a long-term bullish outlook for Bitcoin, provided it can hold $75,000 as a supportive level.

Arthur Hayes, co-founder of BitMEX, advocates for patience amidst market fluctuations. He accurately predicted Bitcoin’s downward trend, previously estimating a drop to $75,000. Hayes cautiously anticipates that Bitcoin could reach $70,000 before a potential rebound, driven by the reaction of central banks to economic pressures. He advises risk-averse investors to wait for signals of easing from central banks before deploying additional capital.

In conclusion, while Bitcoin has experienced a temporary stabilization after recent declines, experts predict continued volatility influenced by macroeconomic pressures and investor sentiment. Analysts advocate for patience and caution, emphasizing a long-term positive outlook for Bitcoin, dependent on broader economic conditions and market strategies.

In summary, the cryptocurrency market, particularly Bitcoin, is facing significant challenges as it grapples with external economic factors and market sentiments. Experts suggest that Bitcoin’s correlation with traditional equities could lead to further declines, with predictions of falling below $70,000. Nevertheless, there remains a cautiously optimistic long-term outlook, contingent on the responses of central banks and the overall market recovery, underscoring the importance of strategic investment amidst volatility.

Original Source: www.dlnews.com

Post Comment