Bitcoin Price Recovery: Risks Ahead and Market Sentiments

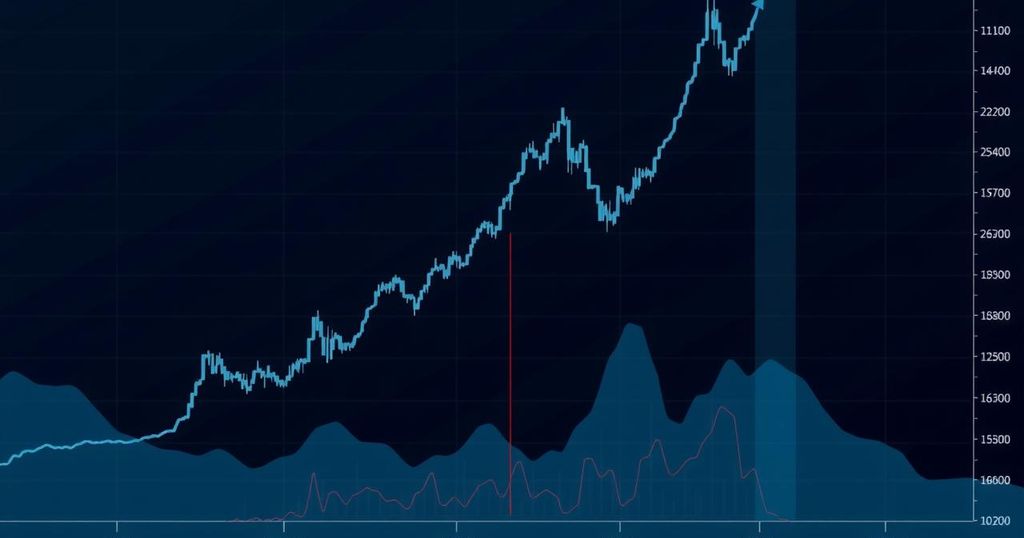

Bitcoin’s recent price recovery shows signs of instability, with risks of further declines continuing. Forced liquidations led to significant drops, but a temporary rebound has been observed. Economic policies and potential recessions are influencing market sentiment, with analysts predicting critical price levels to watch for trend changes in Bitcoin and a nearing bottom for altcoins.

In recent days, Bitcoin has shown signs of a slight recovery, though uncertainties remain regarding its future stability. Speculators may interpret the recent bounce as a potential signal for a bull run; however, significant risks of further declines continue to loom.

On Tuesday, Bitcoin’s price briefly dipped below $77,000, following a notable drop from $86,000 the previous Saturday. Over the weekend, Bitcoin’s price gradually decreased towards $82,000, plummeting first to $79,000 and then further to $77,000 on Monday after the US stock markets reopened. Such sharp declines are typically caused by forced liquidations of leveraged long positions, leading to automatic sales that exacerbate price pressure.

The subsequent rebound observed on Tuesday, alongside the closing of inefficiencies created by Monday’s sell-off, saw Bitcoin rally to $81,000 and momentarily reach $83,000. This recovery, however, should not be misconstrued as a definitive upward trend; rather, it is a temporary pause in the market action. Furthermore, market volatility is projected to return in the latter half of next week, but whether this will present bullish or bearish conditions remains unclear, with sentiments leaning toward negative implications.

Compounding these market challenges are concerns regarding a potential recession in the U.S., attributed to the economic policies of former President Donald Trump, particularly his tariffs, which may stifle wealth generation and heighten inflationary pressures. Despite positive inflation data from February, the true effects of tariffs enacted in March are yet to be fully realized, leading markets to brace for both inflation increases and recession risks.

According to analyst Matthew Hyland, a weekly close above $89,000 would be necessary to signal the end of the current bear trend; however, this outcome currently appears unlikely. Should a renewed bear trend occur, targets for Bitcoin could plummet to $74,000 or even $69,000, potentially erasing gains from earlier trends associated with Trump’s policy.

The situation is markedly different for altcoins. The severe downward trend in many altcoin prices may be showing signs of exhaustion, particularly in Ethereum, which has reached its lowest value since June 2020. Even so, the altseason index suggests the crypto market remains firmly in a Bitcoin phase, with little likelihood of a significant drop in Bitcoin’s dominance. While an altseason may not be imminent, the price declines in altcoins could be nearing completion.

In summary, while Bitcoin demonstrates signs of recovery, the presence of considerable risks points to potential further declines in the near future. The economic landscape, influenced by political factors, underscores concerns over recession and inflation, which may negatively impact financial markets, including cryptocurrency. Bitcoin’s immediate future hinges on volatility in the market, with significant price levels needing to be monitored for indications of trend reversals. Meanwhile, altcoins may be approaching a bottom, despite their current unfavorable conditions.

Original Source: en.cryptonomist.ch

Post Comment