Politics

ASIA, AUTOMOTIVE INDUSTRY, BIDEN, BIDEN ADMINISTRATION, BRAZIL, CALIFORNIA, CHINA, CHRYSLER CORP, COLIN LANGAN, DONALD TRUMP, EUROPE, EUROPE/ASIA, FORD, GEOPOLITICS, HUNGARY, LANGAN, MEXICO, NATIONAL SECURITY, NISSAN MOTOR CO. LTD, NORTH AMERICA, RUSSIA, SOUTH AMERICA, SPAIN, STATES, TARIFFS, U. S, UNITED STATES, US-CHINA RELATIONS, WELLS FARGO SECURITIES

Dante Raeburn

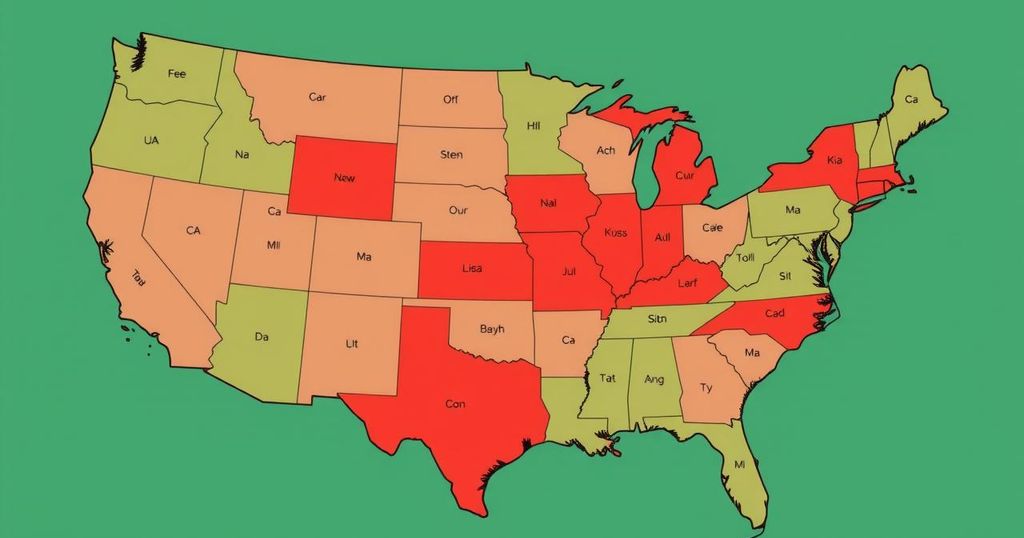

U.S. States Divided Over Welcoming Chinese Automakers

U.S. states display significant divergence in their receptiveness to a Chinese automaker’s investment, addressing the balance between job creation and national security. Analysts suggest partnerships may be a key route for entry, with states like Texas taking a firm stance against Chinese projects, while others like New Mexico show openness. The future may feature collaborative approaches with existing U.S. manufacturers to navigate market entry challenges.

The division among U.S. states regarding the acceptance of a Chinese automaker’s investment stems from the economic benefits versus national security concerns. The prospect of substantial job creation and financial investment is appealing; however, apprehensions about Chinese influence persist. Analysts suggest that other automakers from China are likely to establish manufacturing operations in the U.S. in the near future, similar to historical precedents with Japanese and South Korean companies. Colin Langan of Wells Fargo cited significant job losses as a factor influencing governors’ decisions about Chinese investments, hinting at possible compromises despite anti-China sentiments.

President Trump has stated openness to Chinese automakers establishing plants in the U.S., potentially through new facilities or partnerships. Such strategies have been successfully implemented by companies like Chery Automobile and BYD in various international markets. Langan believes that partnerships, rather than entirely new plants, are more feasible for these companies.

New automotive plants entail immense costs, thereby requiring firms to navigate strict U.S. regulatory measures, including a ban on Chinese internet-connected technology. Sam Fiorani indicated that a Chinese automaker may need to innovate new vehicle technologies to enter the U.S. market effectively. The prior presence of partnerships like that of GM and Toyota exemplifies paths that Chinese companies might explore.

Chinese automotive brands have seen success in Europe due to competitive pricing and incentives, with brands like BYD offering affordable options. However, U.S. consumer recognition of these brands poses a challenge. Lacking familiarity with brands such as BYD and Nio Inc., these companies will need significant investment in marketing to encourage consumer acceptance in North America.

Several U.S. states express resistance to projects involving Chinese automakers. Michigan’s Economic Development Corporation emphasized its commitment to economic strategy but remained non-committal about supporting a specific project. Governor Whitmer warned of the risks posed by foreign competition to Michigan’s auto industry. Notably, Michigan has engaged with Chinese companies, recently attracting Gotion Inc., despite opposition from some political factions.

States like Texas exhibit a firmer stance against Chinese investments, citing national security concerns as a primary factor. South Carolina and Georgia have also placed restrictions on new projects from Chinese firms, invoking laws related to military proximity and national security.

Conversely, New Mexico is more welcoming, presenting itself as a potential hub for automotive investments. Their approach emphasizes job creation without imposing strict conditions based on national origins. Tennessee and Alabama similarly refrain from incentivizing Chinese firms, often citing national security issues.

The potential pathways for Chinese automakers into the U.S. market include partnership models or utilization of defunct plants rather than setting up entirely new facilities. As the automotive landscape remains dynamic, traditional big players like GM are exploring these potentials with existing or defunct operations. However, executives underscore that decisions about future partnerships are still highly conjectural, pointing to a cautious approach as the industry evolves.

In summary, U.S. states are grappling with complex decisions regarding Chinese automakers, weighing the substantial economic benefits of investment against serious national security concerns. While states like Texas and South Carolina exhibit resistance towards such projects, others like New Mexico express willingness to collaborate. The future landscape of the automotive industry may witness innovative approaches, including partnerships and utilization of existing facilities by Chinese firms as they seek to penetrate the U.S. market without establishing new plants. Regardless, the journey toward acceptance remains fraught with challenges.

Original Source: www.detroitnews.com

Post Comment