Analysis of Bitcoin’s Price Decline in August

In August, Bitcoin’s price experienced a notable decline, approximating a 10% drop, while major stock indexes, such as the Dow Jones, Nasdaq 100, and Nifty 50, reached unprecedented heights. This downturn occurred despite the US dollar index decreasing to 100.1, reflecting a decline of over 6% from its annual peak. Historically, Bitcoin has performed favorably during periods of dollar depreciation, making this situation particularly perplexing. Furthermore, the market saw a net addition of $188 million in assets through spot Bitcoin exchange-traded funds (ETFs) amidst the price decrease.

According to the analytical insights provided by Kaiko, the primary factors contributing to the sell-off include apprehension regarding dwindling liquidity in the Bitcoin market and rising trepidations concerning governmental divestments from their Bitcoin holdings. Notably, the German government liquidated its Bitcoin assets in July, and recommendations have surfaced suggesting that the United Kingdom should consider selling its significant stash of 61,000 coins to alleviate a reported budget shortfall of $22 billion. This increasing likelihood of governmental sales raises concerns among investors, particularly given that significant holders of Bitcoin also include the United States, China, and Ukraine, which control holdings of 213,246, 190,000, and 46,351 coins, respectively.

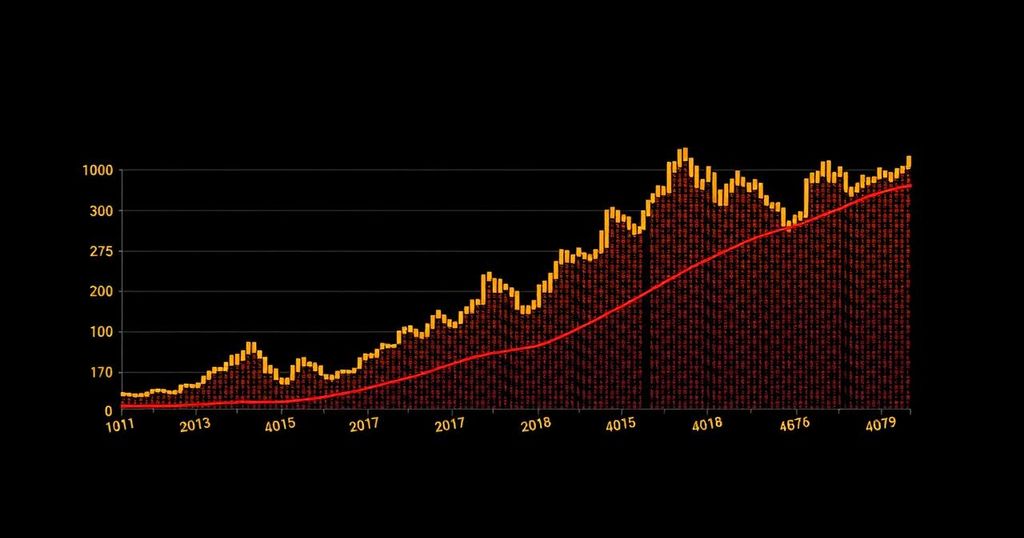

In addition to these factors, the trading volumes in both the spot and futures Bitcoin markets have revealed a subdued atmosphere throughout August. Data from DeFi Llama indicates that decentralized exchanges have managed over $167 billion in trading volume this month, a drop from the $193 billion reported in July. CoinMarketCap further emphasizes that trading volumes peaked on August 5 but subsequently resumed a downward trajectory.

Amidst these challenges, some analysts remain optimistic. A professional from Fundstrat noted that Bitcoin’s trading volume typically experiences a resurgence following the Labor Day weekend, suggesting a potential for increased market activity in September. Moreover, Bitcoin has established a hammer chart pattern on its monthly chart, which may signal a forthcoming rebound, alongside the formation of a cup and handle pattern, both of which are recognized as bullish indicators in market analysis.

Nonetheless, it is imperative to acknowledge the historical context, as September has often been a challenging month for Bitcoin, witnessing declines in eight of the last eleven instances. Investors should approach the upcoming month with caution while remaining attuned to market dynamics that could influence Bitcoin’s performance.

Post Comment