Evaluating the Impact of U.S. Presidential Elections on Bitcoin Pricing Dynamics

The implications of the U.S. presidential election on Bitcoin’s valuation remain inconclusive; it is unlikely that the outcomes of these elections will significantly impact Bitcoin’s pricing trajectory. Historically, market sentiment exhibits volatility and uncertainty in the lead-up to elections, which prompts investors to adopt a more cautious approach, consequently resulting in considerable fluctuations across various financial assets, including Bitcoin.

According to findings from Bitfinex’s research team, the concluding phases of election years tend to be characterized by tumultuous market conditions. Historical data suggests that Bitcoin has frequently experienced a decline approximately two to three months prior to elections, followed by a recovery phase once the election results are finalized. It is essential to emphasize, however, that it is not the election results that drive Bitcoin’s price fluctuations, but rather the prevailing conditions in the broader market that significantly influence these dynamics.

Analyzing Bitcoin’s price behavior in light of U.S. electoral cycles reveals a distinct trend: the cryptocurrency generally depreciates in value before elections and stages a recovery post-election. This recurring phenomenon is not contingent upon the identities of the winning or losing candidates but is intrinsically linked to the electoral timeline and the accompanying market angst typically observed towards the end of the fiscal year. Such uncertainties surrounding elections tend to exert downward pressure on Bitcoin’s price, a trend consistently noted in 2012, 2016, and 2020, where prices dipped prior to the elections and rebounded thereafter.

Moreover, it is crucial to acknowledge that Bitcoin’s movements increasingly mirror those of traditional financial markets, particularly the S&P 500 Index. Whenever the S&P 500 encounters turbulence, Bitcoin appears to respond in kind. This correlation suggests that Bitcoin’s performance is significantly shaped by larger market trends rather than by its inherent characteristics. As the 2024 election approaches, the S&P 500 is reportedly hovering near all-time highs, amidst discussions surrounding potential interest rate adjustments and political shifts that augment market uncertainty.

Upon the conclusion of the electoral process, a post-election relief rally typically ensues, driven by investors’ newfound clarity regarding the political landscape. The market sentiment may shift favorably towards Bitcoin, leading to potential gains in its pricing.

The year 2024 has thus far been particularly tumultuous for Bitcoin, which reached an unprecedented peak exceeding $73,000 in March due to the introduction of spot Bitcoin Exchange-Traded Funds (ETFs). However, its value has since stabilized below the $60,000 threshold. Moreover, speculative commentary surrounding Donald Trump’s positive remarks about Bitcoin has resulted in minor upward movements in its price. If Trump were to secure victory in the upcoming elections, some analysts posit that Bitcoin could surpass its previous all-time high, potentially stimulated by heightened institutional investments and a more favorable regulatory environment.

Conversely, should Kamala Harris ascend to the presidency, there are projections indicating that Bitcoin’s value may dwindle, with estimates as low as $16,000, due to anticipated stricter regulations tied to her policies. Nonetheless, some contend that Harris’s potential regulatory stances could inadvertently contribute to a rise in Bitcoin’s valuation, particularly if her policies lead to depreciation of the U.S. dollar.

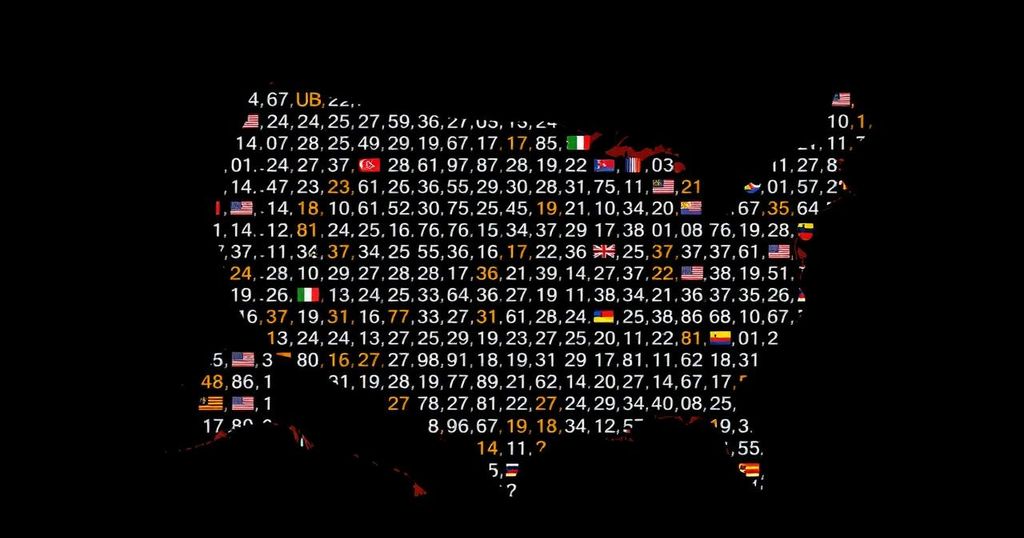

It is essential not to overanalyze the situation, for forecasts indicate a nearly even split in voting odds—Donald Trump possesses a 50% probability of victory, while Kamala Harris stands at 49%. The dramatics surrounding the presidential election may captivate viewers; however, it is evident that the outcomes of the elections will not singularly dictate the trajectory of Bitcoin’s pricing.

Post Comment