Bitcoin Price Forecast for September 2024: Anticipating a 25% Surge

**Bitcoin Price Forecast for September 2024: Anticipating a 25% Surge**

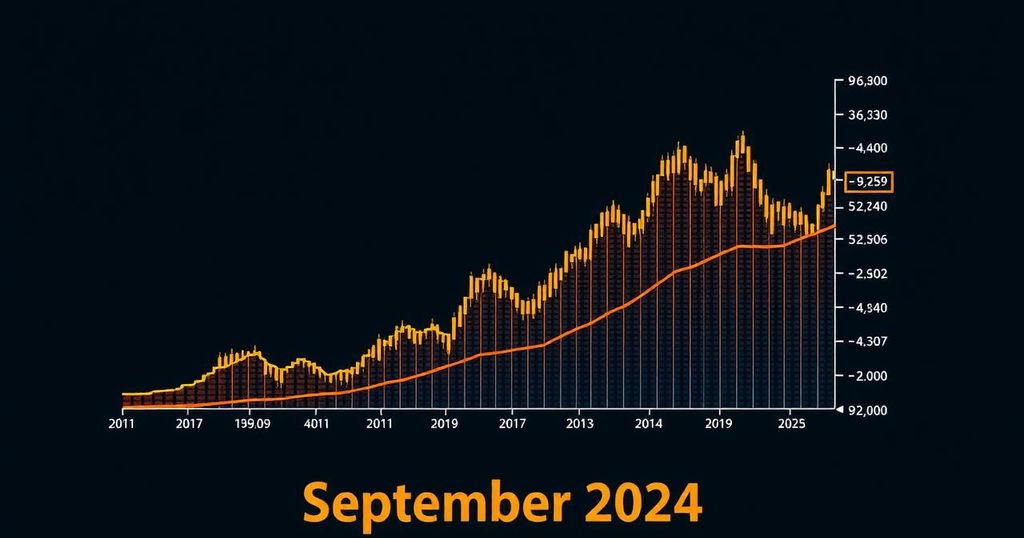

Bitcoin is currently experiencing a challenging phase, evidenced by a recent decline of 2% which has resulted in its valuation decreasing to $57,477. This downturn can be largely attributed to a substantial outflux of $277 million from Bitcoin Exchange-Traded Funds (ETFs), fostering a bearish sentiment across the market.

Despite these setbacks, there remains optimism among certain cryptocurrency analysts regarding the potential for a significant upward movement in Bitcoin’s price. Notably, Captain Faibik, a recognized figure within the crypto trading sphere, posits that Bitcoin is currently operating within a bullish flag pattern. This specific technical formation is often interpreted as a signal for continuation in a positive trend, suggesting that Bitcoin could be on the verge of resuming its upward movement.

However, Captain Faibik also underscores the importance of maintaining the $54,000 support level, which has historically served as a robust barrier against further declines. A successful defense of this critical level may allow for a recovery that could see Bitcoin rallying to $68,000 by September.

Additionally, Moustache, another prominent trader in the crypto community, echoes this sentiment, noting Bitcoin’s resilience over the past seven months as it consistently closes above its previous all-time high. He highlights the strength of Bitcoin’s monthly performance, which indicates that the market may be approaching a pivotal moment poised for a price increase.

Moreover, the upcoming decision by the U.S. Federal Reserve regarding a potential interest rate cut on September 18 could serve as a catalyst for a price surge in Bitcoin and other cryptocurrencies. Analysts speculate that such a monetary policy shift could enhance investor confidence and lead to notable gains in the cryptocurrency market in the forthcoming months.

In conclusion, while Bitcoin currently faces pressure from market conditions, the combination of technical indicators, historical resistance levels, and external economic factors could very well set the stage for a rebound. Observers are encouraged to stay informed as developments unfold, particularly regarding the anticipated Federal Reserve decision and its implications on Bitcoin’s trajectory in September 2024.

Post Comment