Bitcoin’s Resilience Amid Bearish September Trends: Recovery to $58,300

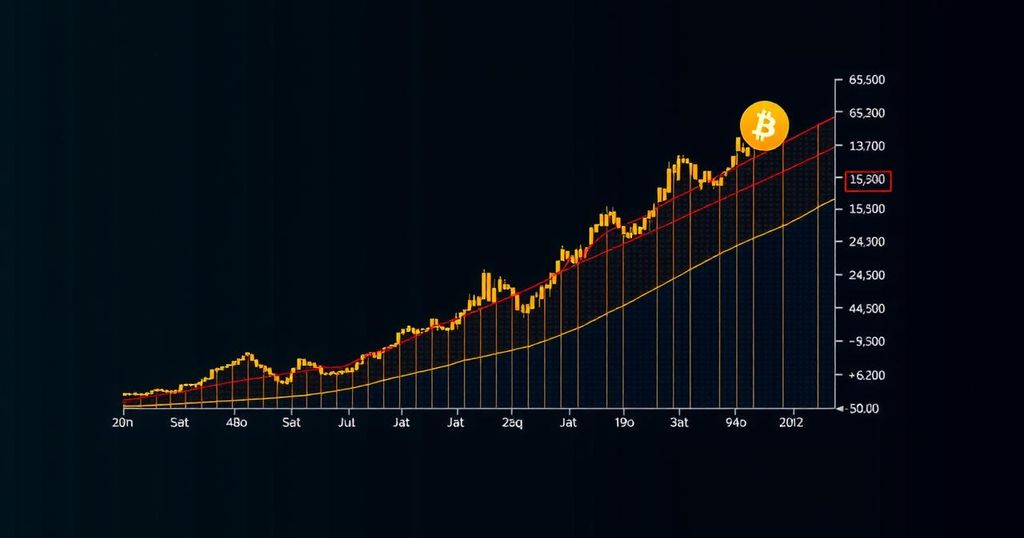

In the wake of the traditional bearish sentiment associated with the month of September, Bitcoin (BTC) has demonstrated resilience, rebounding to approximately $58,300 after previously dipping to near $57,500. This positive movement represents a 0.5% increase, although Bitcoin remains down 8.6% over the past week. Concurrently, other cryptocurrencies, including notable tokens such as Dogecoin (DOGE) and Toncoin, have faced declines of up to 5% amidst the U.S. Labor Day holiday.

Market analysts have noted September’s historical tendency to exhibit a bearish trend for Bitcoin, with an average decrease of 6% during this month. Recent data indicates that Bitcoin exchange-traded funds (ETFs) have experienced total net outflows of $175 million over the past four days, while Ether (ETH) ETFs maintained no inflows or outflows despite a trading volume of $173 million, according to reports from SoSoValue.

Despite the prevailing negative trend, some traders express optimism that potential interest rate cuts by the U.S. Federal Reserve could alter this seasonal pattern. Innokenty Isers, founder of Paybis, pointed out that historical data reveals September typically results in a value depletion rate for Bitcoin of approximately 6.56%. However, should the Federal Reserve opt for a rate reduction, it could foster a more favorable economic environment for Bitcoin, enhancing its position as a store of value amidst increased liquidity in the market.

It is crucial to recognize that seasonality reflects the recurring trends in asset prices throughout the year, influenced by various factors including market speculation and consumer behavior surrounding taxation and holiday seasons. Looking ahead, analysts believe that macroeconomic indicators, prospective adoption of Bitcoin spot ETFs, and improvements in network functionality may render September a more advantageous month for Bitcoin than in previous years.

In summary, while current trends signal caution for Bitcoin investors at the onset of September, there remains a potential for positive developments that could reshape the outlook for the cryptocurrency in the near future.

(UPDATE Sept. 2, 13:47 UTC): Updates prices in the headline and first two paragraphs.

It is important to note that CoinDesk operates independently following the acquisition by the Bullish group in November 2023, which emphasizes adherence to stringent editorial policies to uphold journalistic integrity.

Post Comment