Market Analysts Remain Optimistic on Bitcoin’s Future Despite Recent Price Decline

In recent developments within the cryptocurrency market, the recent fluctuations in Bitcoin’s price have led to significant speculation regarding the sustainability of its bullish trend. Following a sharp decline below the $50,000 mark last month, many analysts have analyzed the potential impact on the much-anticipated bull run. Notably, prominent crypto analyst, CryptoCon, remains optimistic, asserting that despite the current price corrections, a substantial rally toward the $100,000 threshold remains plausible.

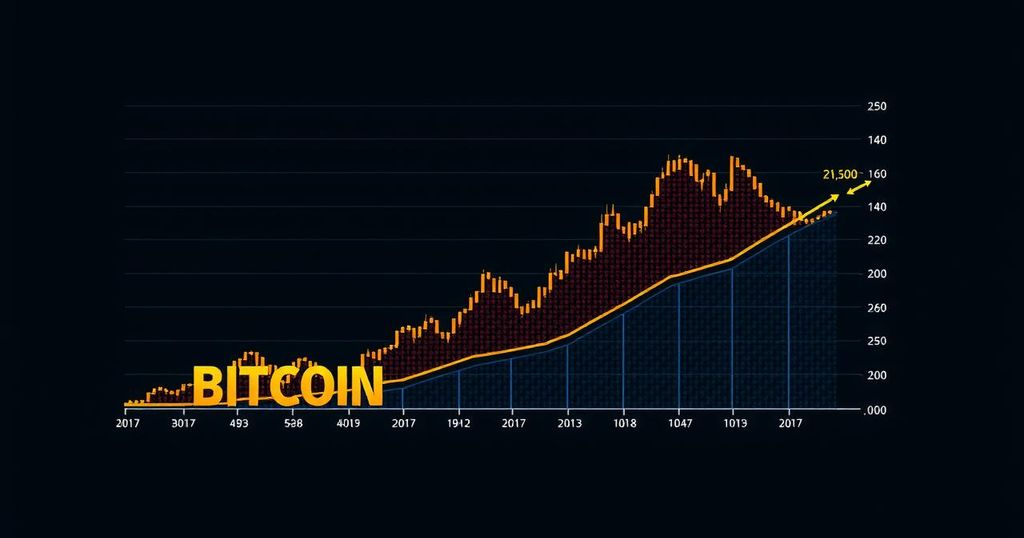

CryptoCon has characterized the recent price drop as a transient setback, emphasizing that the overall bullish trajectory of Bitcoin remains intact. In a statement posted on X (formerly Twitter) on August 28, CryptoCon expounded upon this assertion, drawing upon historical price trends to predict a forthcoming resurgence. He presented a comprehensive Bitcoin price chart delineating various halving cycles from 2013, each of which exhibited a similar bullish behavior following initial declines.

The analyst elucidated a recurring phenomenon observed in Bitcoin’s price fluctuations associated with its halving events. History reveals that prior to and following the halving cycles, the cryptocurrency typically experiences an initial dip in value, followed by a pronounced bullish shift. Citing examples from previous halving cycles in August 2012, 2016, and 2020, CryptoCon noted that the typical pattern involves periods of subdued price activity before culminating in notable price escalations in the subsequent years—referred to by him as the “Red Year.”

Predictably, CryptoCon has re-evaluated his projections for the peak price Bitcoin could achieve during the current cycle, adjusting the forecast upward from a range of $90,000 to $130,000 to a more ambitious $110,000 to $160,000.

Additionally, another analyst known as ‘Kyledoops’ echoes this bullish sentiment, articulating that while Bitcoin’s net capital inflow is displaying a gradual deceleration, such trends historically precede substantial market volatility. Kyledoops posits that this current period of relative inactivity could serve as a precursor to imminent price swings, suggesting that investor sentiment could rapidly shift.

As it stands, Bitcoin’s price is trading at approximately $58,051, reflecting a decline of 9.07% over the prior week, according to CoinMarketCap. Despite persistent bearish pressures, Bitcoin appears determined to regain stability above the $60,000 threshold.

In conclusion, while the recent decline in Bitcoin’s price may induce caution among investors, key analysts remain steadfast in their outlook, reinforcing the notion that the cryptocurrency market continues to be on the verge of significant upward movement. The historical context provided by their analyses serves to bolster confidence in Bitcoin’s potential trajectory as it navigates through these corrections.

Post Comment