Potential Declines in Bitcoin Price: A Comprehensive Analysis

The current outlook for Bitcoin (BTCUSD) reflects a troubling downtrend, having decreased by over 3% in the past week alone, effectively erasing significant gains made since the low of $49,500 recorded on August 5. Over a 90-day period, the price has plummeted by 20%, accompanied by a concerning 32% reduction in daily trading volume. Several analytical indicators suggest that a continued correction is imminent, making a rapid recovery from the current price levels increasingly improbable.

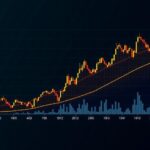

Analysts from 10x Research have predicted a potential decline of Bitcoin to the low $50,000 range. In this context, Markus Thielen from 10x Research presented a chart illustrating that the recent price correction has led Bitcoin to fall beneath the ascending trendline of an asymmetrical triangle. The breakdown of this supportive trendline indicates a possible retest of the lows seen in early August, likely dipping below the $50,000 threshold.

Similarly, Michael Van de Poppe, founder of MN Capital, supports this sentiment, noting that a breach below the August 15 low of $56,000 has emerged as a key factor. He emphasizes that this shift was intended to target the demand-side liquidity beneath it, yet the anticipated upward momentum did not materialize, thereby positioning Bitcoin at risk for additional drops towards levels of $53,000 or even $49,000 before any possible recovery occurs. Additionally, analysts at Glassnode foresee Bitcoin trending downward towards the $51,000 mark, recognizing this level as historical support and the market mean.

The scenario worsened as Bitcoin fell from a peak of $65,000 on August 25 to a recent three-week low of $55,555 on September 4, further underscoring the risk inherent in the market. Following this decline, Bitcoin has broken below the significant 200-day exponential moving average (EMA) again, a critical support indicator typically relied upon during bullish trends. This breach indicates increased resistive pressure around the $58,000 mark, as noted by prominent trader Skew, suggesting difficulty for Bitcoin bulls in reclaiming this crucial level. Currently, the 200-day EMA stands at $59,533, situated above the prevailing market price, indicating heightened risks for investors moving forward.

Upon analyzing the In/Out of the Money Around Price (IOMAP) data provided by IntoTheBlock, it becomes evident that Bitcoin is confronted with notable resistance in its upward trajectory, particularly within the range of $57,928 to $59,668 where approximately 929,367 BTC have been acquired by around 1.98 million addresses. This underscores the limited potential for significant rebound movements in the near term, and may culminate in further downward corrections.

Additionally, the recent formation of a bear flag pattern reveals a typical corrective setup post an established downtrend. The attainment of this technical formation suggests a targeted downside of approximately $45,450, a level that harkens back to early February. Compounding this bearish sentiment is the daily relative strength index, which currently registers a negative 44, implying that prevailing market conditions favor further declines, thereby enhancing the probability of Bitcoin approaching its bear flag target. In summary, the prevailing indicators and analytical insights suggest that Bitcoin is poised for potential declines, with analysts watching key support levels closely amidst a turbulent market condition.

It is imperative to remain vigilant concerning market movements, as shifts can occur rapidly in the cryptocurrency landscape. Analysts and investors alike should consider leveraging these insights in their strategic planning and risk assessment.

Post Comment