Goldman Sachs Warns of Possible Market Crash Amid Bitcoin Price Prediction Revisions

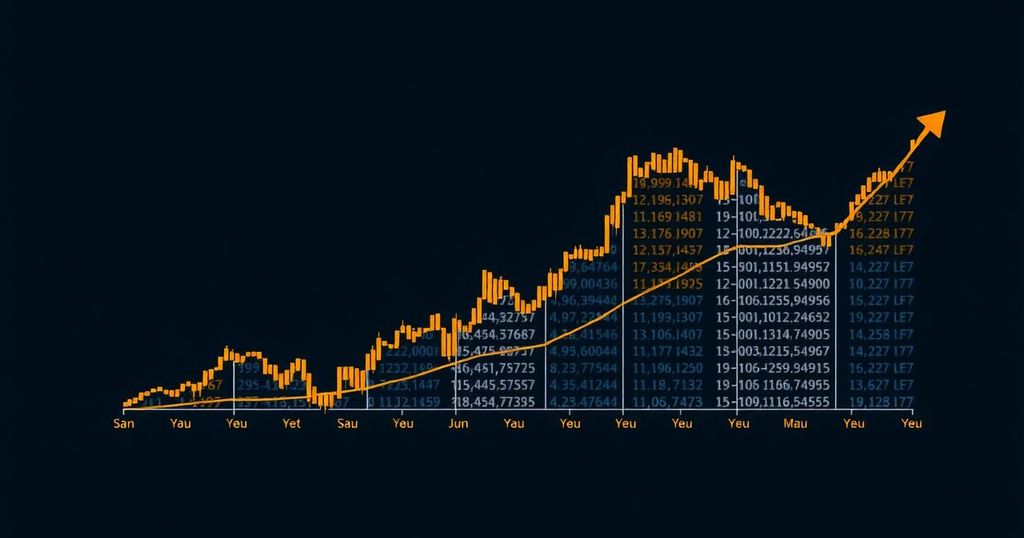

In a recent turn of events, Goldman Sachs has issued a significant warning regarding a potential crash in the stock market, fueled by the upcoming jobs report that may impact the Federal Reserve’s monetary policy. Bitcoin, which experienced a substantial surge earlier this year, is now facing pressure and uncertainty, particularly due to traders’ concerns over the Federal Reserve’s monetary strategies. Analysts at Goldman Sachs have emphasized that weak payroll data could precipitate a market correction, which has created heightened caution among investors in both the cryptocurrency and equity markets.

According to Scott Rubner, managing director for global markets at Goldman Sachs, this Friday’s payroll report holds considerable weight, as it is crucial for determining the Fed’s decision on interest rates in September. Anticipations suggest that the report will indicate an increase in hiring and wage growth, which may prompt the Federal Reserve to enter a cycle of rate cuts. The current economic data and remarks from Federal Reserve officials indicate a growing likelihood of such a move, heightening concerns regarding the stability of the financial markets.

September is historically recognized as a challenging month for stock performance, with Bitcoin often reflecting similar bearish tendencies. However, Rubner argues that the U.S. elections in November could serve as a turning point for risk assets, potentially paving the way for a rally in cryptocurrency prices, irrespective of whether Donald Trump or Kamala Harris emerges victorious.

In light of these developments, Arthur Hayes, the co-founder of BitMex and a notable figure in cryptocurrency trading, has revised his short-term predictions regarding Bitcoin. Previously anticipating a bull market due to expansive liquidity from major financial institutions, Hayes now cautions that the cryptocurrency may fluctuate around its current levels, or potentially decline towards $50,000 before anticipated interventions to bolster the market begin in late September. His updated outlook mirrors bearish sentiments expressed by analysts at Bitfinex, who foresee Bitcoin potentially falling to $40,000 in the near term.

In conclusion, as both stock and cryptocurrency markets brace for crucial economic indicators and possible shifts in Federal Reserve policy, investors must remain vigilant and acknowledge the increasing risks inherent in the current financial landscape.

Post Comment