Implications of US Bond Yield Changes on Bitcoin Amid Fed Rate Cut Speculations

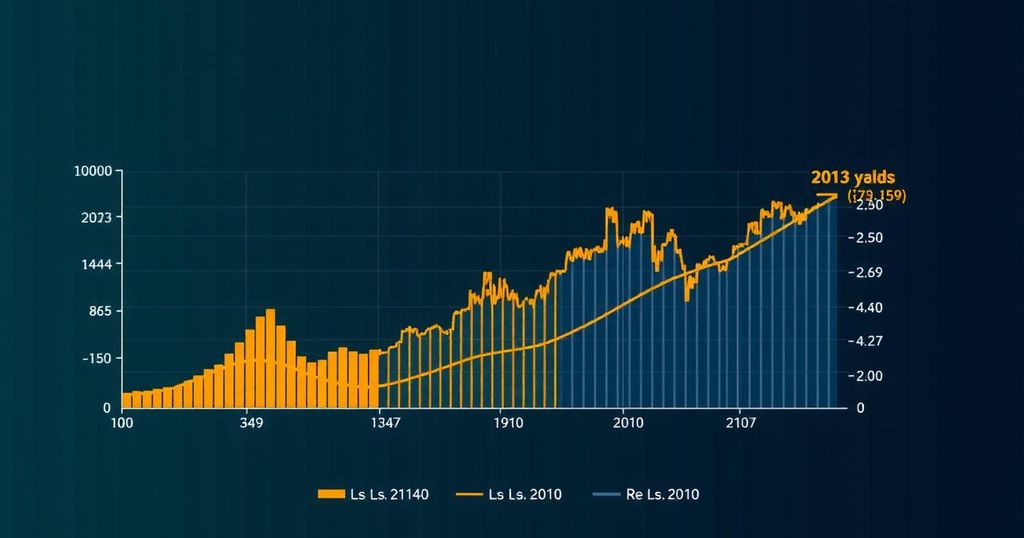

The recent contraction in United States bond yields, compounded by subpar labor data, has raised apprehensions regarding the economy and has heightened the likelihood of a rate cut by the Federal Reserve. This pattern bears significant implications for Bitcoin and other cryptocurrencies. Historical data indicates that the current conditions, including the lowest level of job vacancies in the United States since 2021 and the narrowing spread between 2-year and 10-year Treasury yields, compel investors to reassess their positions in both traditional financial markets and riskier assets such as Bitcoin.

The interaction between US bond yields and the cryptocurrency market has grown increasingly pertinent as the Federal Reserve endeavors to maintain equilibrium in its monetary policy. Typically, a downturn in labor market metrics—which is exemplified by the recent drop in job openings—tends to lead to Federal Reserve interest rate reductions. These reductions can inject liquidity into financial markets, thus potentially catalyzing bullish movements in Bitcoin and similar assets. Increased financial conditions and the influx of fresh capital into risk-oriented asset classes could favor a positive outlook for Bitcoin following rate cuts.

Nevertheless, the narrowing of US bond yields introduces a nuanced challenge. Should the yield curve disinvert, indicating market anticipation of Federal Reserve rate cuts, it may engender a risk-on attitude amongst investors, prompting an inclination towards speculative investments, such as Bitcoin. In contrast, a reinversion of the curve could signal abiding fears of recession, suggesting a possibility of further monetary tightening—a scenario that typically curtails liquidity, thereby exerting pressure on the cryptocurrency market and complicating its price recovery prospects.

Historically, the cryptocurrency markets have thrived when US bond yields indicated a shift towards easier monetary policy. Thus, a potential weakening of the labor market leading to enacted rate reductions could facilitate a resurgence in crypto prices. However, persisting ambiguities within the bond market could obscure the long-term prospects for Bitcoin and other digital currencies, especially if investors are concerned about the plausibility of further economic constraints.

In summary, the narrowing of US bond yields raises important questions regarding future monetary policy decisions by the Federal Reserve. Speculation is rife that a rate cut may be imminent, particularly as disinversion of the yield curve suggests an expectation of monetary easing, which could mitigate recession risks. Conversely, should the yield curve reconverge with short-term rates eclipsing long-term ones, the specter of economic contraction would loom larger, likely prompting the Federal Reserve to consider aggressive rate cuts to stave off downturns. For Bitcoin and the broader cryptocurrency market, lower interest rates could signify increased liquidity, although the overarching threat of recession risk could inhibit lasting bullish activity. Ultimately, investors within the cryptocurrency sphere will need to maintain diligence regarding these fundamental indicators as they monitor developments in bond yields and impending Federal Reserve policy resolutions.

Post Comment