Analyzing the August Decline of Bitcoin-Related Stocks

In the month of August, numerous stocks associated with the prominent cryptocurrency Bitcoin (BTC) experienced significant declines. Data from S&P Global Market Intelligence reveals noteworthy examples of this trend. Exchange-traded funds (ETFs) linked to Bitcoin’s spot price, such as the iShares Bitcoin Trust ETF (IBIT), closely mirrored Bitcoin’s substantial price drop of 10.4%. Moreover, companies like MicroStrategy (MSTR), which has drawn considerable interest from Bitcoin investors, and Riot Platforms (RIOT), a cryptocurrency mining entity, showcased pronounced volatility owing to their ties to the unpredictable Bitcoin market. Notably, MicroStrategy’s stock plummeted by 18%, while Riot’s investors faced a staggering 26% loss.

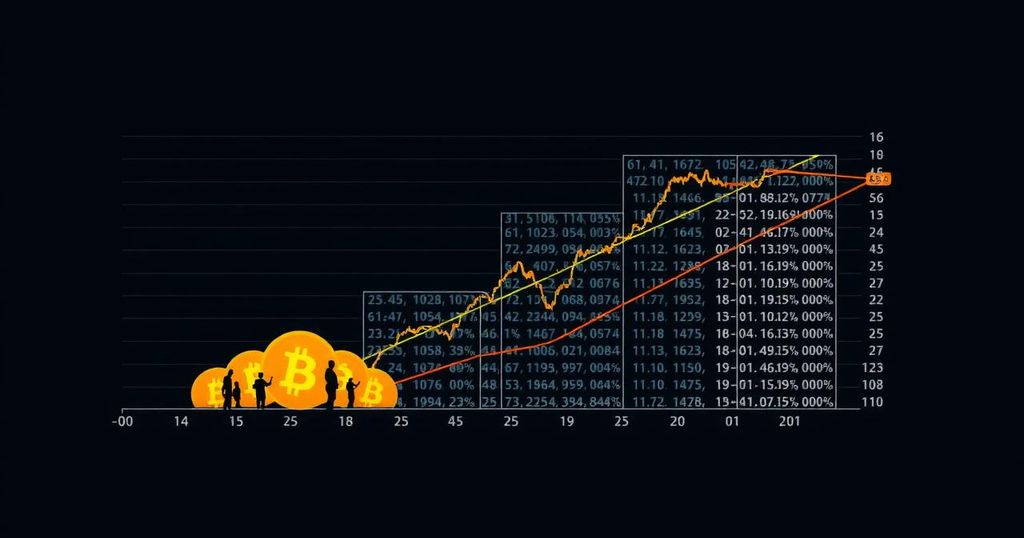

The primary inquiry arises: what caused the downturn in Bitcoin’s value throughout August? Given that the cryptocurrency sector was anticipated to enter a significant upward trajectory, especially with the anticipated halving of mining rewards, the sudden price decrease was perplexing. The four-year cycle of Bitcoin price surges, triggered by the halving of miner rewards—which effectively reduces the inflation rate—had led many to expect a robust performance from the cryptocurrency. Furthermore, the influx of capital into newly established spot Bitcoin ETFs was expected to enhance this upward momentum. However, Bitcoin’s value still languished 21% below its all-time high of $73,750 reached in March, which occurred shortly before the critical halving event.

Upon investigation, it appears that a blend of economic uncertainties and misinterpretations regarding the halving cycle contributes to these fluctuations. Bitcoin is perceived as a high-risk investment, rendering it particularly sensitive to economic shifts. For example, Bitcoin tends to thrive during periods of low interest rates, while rising rates generally exert downward pressure on its value. The ambiguity surrounding future interest rate trajectories has had an adverse impact on Bitcoin prices, a pivotal factor in the price decline observed in August 2023.

There was speculation that the Federal Reserve would soon initiate a reduction in interest rates. However, conflicting economic indicators reduced optimism concerning such policy adjustments in early August. While there remains potential for the release of favorable news regarding interest rates, the outlook was far from certain by the end of August. Consequently, Bitcoin contended with various economic challenges throughout the month. Additionally, the anticipated price increase typically associated with the rewards halving tends to manifest several months post-event, as observed in previous cycles. For instance, following the 2016 halving, Bitcoin experienced a 5% price decline three months afterward but rebounded with a 40% rise after another three months, culminating in a staggering 262% increase within a year. Comparatively, the 2020 halving exhibited a more aggressive response, resulting in a 31% gain after three months and an annual gain of 534%.

It is essential to recognize that each cycle bears unique characteristics, and while cryptocurrency enthusiasts like MicroStrategy’s chairman Michael Saylor predict significant price spikes, such optimism should be tempered by cautious analysis of historical patterns. As a company closely tethered to Bitcoin’s fortunes, MicroStrategy has showcased its risky yet potentially rewarding strategy, holding an impressive 226,331 bitcoins valued at approximately $13.4 billion currently, albeit a decline from $14 billion at the end of the preceding quarter. Their revenue from software operations yielded only $11 million, a stark contrast to the impacts of fluctuating Bitcoin values.

Riot Platforms heightens this risk due to its direct dependency on Bitcoin mining. The company’s mining costs soared to $25,327 per coin in the second quarter of 2024, significantly exceeding the $5,734 cost from the same period the prior year. Maintaining viability in the current economic climate necessitates an upward trajectory in Bitcoin’s market value.

In conclusion, investments in companies like MicroStrategy and Riot Platforms amplify the inherent risks associated with Bitcoin, yet they also present the potential for significant returns, provided they navigate through challenging market conditions. Investors must exercise judiciousness in assessing their risk tolerance and should approach investments in cryptocurrency with careful consideration, particularly in light of the volatility witnessed during the month of August.

Post Comment