The Significance of Bitcoin’s Active Address Volatility in Reflecting User Engagement Beyond Price Movements

In recent months, the volatility of active Bitcoin addresses has underscored a level of user engagement that transcends mere price fluctuations within the cryptocurrency market. The term “active addresses” refers specifically to the unique Bitcoin addresses that have been involved in transactions, whether as senders or receivers, during which the transactions were successfully executed.

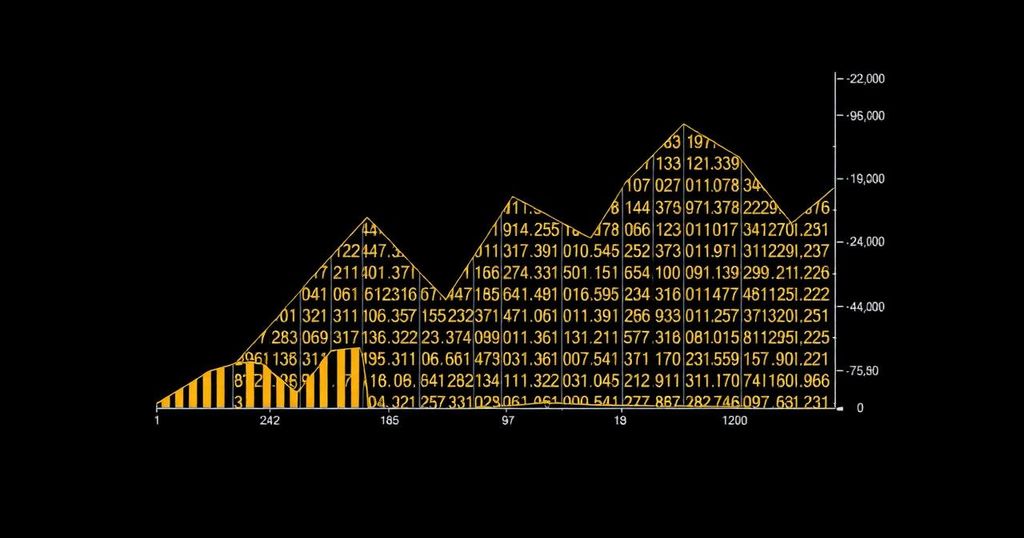

Throughout the year 2024, there has been a notable fluctuation in the number of active Bitcoin addresses. Following a consistent upward trend leading to the halving event that occurred in April, the activity surged beyond 1 million addresses. However, this peak was shortly followed by a considerable decline. As of September, the number of active addresses has stabilized around 650,000.

This pattern of activity closely mirrors the broader dynamics of the Bitcoin market, particularly as the price of Bitcoin experienced a significant rally before settling at just below $60,000. An examination of historical data reveals that active addresses have consistently served as a vital indicator of market engagement. When contrasting current levels with those observed during previous market cycles, it is evident that while the number of active addresses remains below the peak levels of 2021, the present engagement is noticeably higher than that seen during the initial phases of previous bull markets, such as those experienced in 2016 and 2017.

This trend suggests a sustained level of user engagement within the Bitcoin network, despite recent price corrections. Such engagement may be indicative of a resilient network, potentially laying the groundwork for future growth and stability. In conclusion, the vitality of active Bitcoin addresses serves as a crucial metric, reflecting continued user involvement that may contribute to the long-term strength of the cryptocurrency ecosystem.

Post Comment