Bitcoin Price Decline Amid Labor Market Dovishness Signals Bearish Trends

On September 6, 2024, the price of Bitcoin experienced a substantial decline, plunging to $53,334, despite the release of dovish figures from the United States Non-Farm Payroll (NFP) report. This downturn marks a significant continuation of a broader bearish trend, as Bitcoin has decreased by 28% since peaking earlier in the year. Recent on-chain analytics indicate that this price drop correlates with a notable reduction in network activity, contributing to growing concerns among investors.

During the final week of August, Bitcoin recorded a loss of 9.35%, further exacerbated by an additional 9.64% decline in early September. Many traders had anticipated a recovery in Bitcoin’s price, expecting that the dovish labor market data would bolster bullish sentiments. However, the actual results from the US Bureau of Labor Statistics revealed that the economy added 142,000 jobs in August, exceeding July’s figures but falling short of the expected 160,000. The unemployment rate slightly decreased to 4.2%, yet manufacturing jobs saw a significant decline of 24,000.

Analysts at ForexLive noted a 43% likelihood of a 50 basis point rate cut, with 110 basis points of easing projected for the remainder of the year. Unfortunately for bullish traders, this data was insufficient to stimulate substantial buying interest in Bitcoin, resulting in a muted price response following the NFP report.

Compounding these challenges, the Bitcoin network has demonstrated a significant downturn in user engagement over the past five months. The number of unique wallet addresses actively conducting transactions has dwindled to 818,273, the lowest level observed since 2021, and representing a striking 39% decrease from the 1.13 million active addresses noted on March 13, 2024, coinciding with Bitcoin’s all-time high.

This sustained drop in daily active addresses often serves as an indicator of diminishing investor interest, with previous instances of similar declines typically resulting in corresponding price drops. Accordingly, the downturn in network activity has played a critical role in Bitcoin’s retracement from its peak of $72,300.

Amidst this landscape, Mr. Kyle Doops, a respected analyst and host of the Crypto Banter show, offered a counter-narrative by interpreting the decline in active addresses as a potential pause in market activity rather than a clear indication of a bear market. He posited that investors may be adopting a wait-and-see approach in light of broader market influences, including the potential implications of upcoming exchange-traded funds (ETFs) and the US presidential election. A rebound in active addresses could signal a resurgence in Bitcoin’s price, according to Mr. Doops.

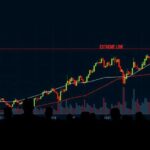

As of September 6, Bitcoin fell 5% within the daily timeframe, further sinking into a bearish territory. Current indicators, including the Bollinger Bands and the Relative Strength Index (RSI), suggest that Bitcoin may be at risk of a sharp decline towards the $50,000 mark in the near future. Specifically, Bitcoin’s price recently fell below its lower Bollinger Band of $54,151, which traditionally portends further depreciation when market sentiment remains negative. Additionally, the RSI has descended to 32.63, approaching the oversold threshold of 30.

Strategically inclined investors must now remain vigilant concerning market indicators and forthcoming policy pronouncements from US Federal Reserve officials. Should future data suggest a more dovish stance, it could foster favorable market reactions, potentially enticing buyers back into the cryptocurrency market as the next Fed rate decision approaches on September 17. In such a scenario, Bitcoin would need to surpass the resistance level of $64,887, as indicated by the upper Bollinger Band.

Post Comment