Can US CPI Propagate Bitcoin Price Recovery Following Debate-Induced Decline?

Summary

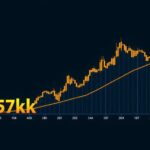

The Bitcoin price experienced a decline to $56,000 following the Trump-Harris debate, with market sentiment favoring Harris as the debate’s winner. The upcoming US Consumer Price Index (CPI) report could significantly impact Bitcoin’s recovery, with various scenarios based on inflation outcomes influencing market expectations and the possibility of rate cuts by the Federal Reserve.

The recent debate between presidential candidates Donald Trump and Kamala Harris, held on September 10, resulted in increased volatility within the financial markets, with Bitcoin’s price declining to approximately $56,000. Following the debate, sentiment regarding Harris’s performance has shifted significantly, as indicated by Polymarket, which reports that bettors considered her the clear winner, significantly influencing market behaviors. The debate triggered a widespread sell-off, impacting not only Bitcoin but also other assets, such as US Crude Oil and the HangSeng Index, reflecting prevailing risk-off conditions across investment landscapes. As market participants seek to ascertain the debate’s outcome and its implications for the cryptocurrency market, attention turns to the upcoming US Consumer Price Index (CPI) report, which is anticipated to further dictate Bitcoin’s market trends. Forecasts suggest a slight decrease in headline inflation from 2.9% to 2.7%, with the consensus hovering around 2.6%. This CPI print holds substantial weight; a lower-than-expected inflation rate could bolster the prospect of a Federal Reserve rate cut on September 18, encouraging a potential rally in Bitcoin price. Conversely, if inflation exceeds expectations, it might dampen market enthusiasm and hinder Bitcoin’s recovery beyond the $60,000 mark. Analyzing the Bitcoin price chart reveals a crucial downtrend, characterized by a series of consecutive lower highs and lows. The recent swing low established on September 6 could potentially represent a turning point, facilitating a recovery toward critical price levels between $60,000 and $70,000, contingent upon favorable CPI results. Achieving a higher high above $65,000 is vital to signal the end of a six-month downward trend, as historical analysis indicates that the fourth quarter could present opportunities for bullish momentum. However, should inflation come in higher than expected, it could compel the Federal Reserve to reassess its rate-cutting strategy, leading to further declines in Bitcoin’s price, possibly retreating to support zones between $50,701 and $52,271.

The context of the article lies within the interplay between political events and cryptocurrency market reactions. The debate between Trump and Harris on September 10 has sparked significant discussion regarding its immediate impact on asset prices, particularly Bitcoin. In addition, macroeconomic indicators such as the Consumer Price Index are pivotal in shaping market sentiment and future Federal Reserve policy, which considerably affects Bitcoin and other risk assets.

In conclusion, the recent Trump-Harris debate introduced notable volatility, leading to Bitcoin’s price decline, while the upcoming CPI report stands as a critical determining factor for the cryptocurrency’s recovery potential. The outcomes of inflation measurements will significantly influence market strategies and the trajectory of Bitcoin’s price in the near term. Investors remain cautiously optimistic, hoping for favorable CPI results to reignite bullish momentum in Bitcoin markets.

Original Source: coingape.com

Post Comment