Bitcoin Mining Difficulty Reaches Record High Amidst Surge in Hash Rate

Summary

Bitcoin’s mining difficulty surged by 3.6%, reaching an all-time high of 92.67 trillion, due to an unprecedented hash rate of 693.84 EH/s. After the April halving event, mining revenues plummeted for many, yet U.S.-based miners are adapting by increasing capacity. Bitcoin trades at $57,670, reflecting ongoing market influences from mining.

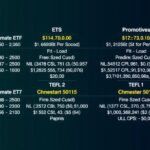

The Bitcoin mining difficulty has recently experienced a significant increase of 3.6%, reaching an all-time high of 92.67 trillion as of Wednesday, as reported by The Block. This adjustment took place at block height 860,832, surpassing the previous record of 90.67 trillion established in July. Mining difficulty serves as a relative measure of the challenge associated with mining new blocks, with the protocol automatically adjusting difficulty approximately every two weeks, or every 2016 blocks, to ensure that a new block is mined roughly every ten minutes. This surge in mining difficulty correlates with an unprecedented increase in Bitcoin’s hash rate, which has now reached 693.84 exahashes per second (EH/s) as measured over a seven-day moving average. This uptick in hash rate follows a brief decline experienced after Bitcoin’s fourth halving event in April, which halved block rewards from 6.25 BTC to 3.125 BTC. Consequently, miners’ revenue saw a substantial drop from a seven-day moving average of $72.4 million to between $25 and $30 million, resulting in the exit of less efficient miners from the ecosystem. Moreover, the Bitcoin hash price, which reflects the expected earnings for each terahash of computational power, reached record lows of $0.04 this month. Despite these market challenges, publicly traded mining companies in the United States are actively increasing their operational capacities, upgrading their mining rigs, and consolidating market share, thereby contributing positively to the overall hash rate. Bitcoin, currently trading at $57,670 with a slight uptick of 0.9%, indicates that while the cryptocurrency market remains influenced by the dynamics of mining, miners are adjusting to these evolving conditions. The topic of increasing mining difficulty and its implications for the future of Bitcoin will be explored further at the Benzinga’s Future of Digital Assets event scheduled for November 19, where industry leaders will convene to discuss these trends affecting digital finance.

The topic of Bitcoin mining is pivotal to understanding the broader cryptocurrency landscape. Bitcoin operates on a decentralized network where miners utilize computational power to verify transactions and secure the network. The difficulty of mining adjusts periodically based on the total hash rate, ensuring that new blocks are added to the blockchain at a consistent rate of approximately every 10 minutes. The halving events, such as the one that occurred in April, significantly impact miners’ profitability and the overall mining ecosystem, influencing the number of active miners and the overall computational power dedicated to mining Bitcoin. The dynamics of mining efficiency, revenue adjustments, and public trading of mining firms underscore the complex interactions within the Bitcoin economy.

The recent record-breaking increase in Bitcoin mining difficulty to 92.67 trillion exemplifies the challenges miners face amidst fluctuating market conditions. Although the current environment poses hurdles, particularly in terms of profitability and hash price, the resilience of U.S.-based miners in expanding their capacities highlights an adaptive response to evolving industry challenges. The upcoming Benzinga event will offer further insights into how these trends are expected to shape the future of digital finance.

Original Source: www.benzinga.com

Post Comment